With the advent of commission-free trading, investors have more opportunities to trade without worrying about hefty fees. Some of you might not know this, but at one point in the 1970s, they were as high as 1% of your trade.

And now, in the cutthroat brokerage world, it has reduced to 0. Seriously, though, how much can one earn from ads and subscriptions? As it turns out, a lot.

Because here’s the thing: brokerage firms aren’t running charities. They have clever ways to keep the lights on and the profits rolling in, even without those commission fees.

First, I will cover a few basics and explain what a brokerage firm is and what zero-commission actually means. So, if you already know this, you can skip ahead.

What is a Brokerage Firm?

A brokerage firm, also known as a stock brokerage, is a financial institution that facilitates the buying and selling of financial securities such as stocks, bonds, and mutual funds on behalf of its clients / customers.

These firms, like Schwab, act as intermediaries between buyers and sellers in financial markets. Traditionally, brokerage firms make money through commissions.

When you execute a trade, the brokerage would charge a fee which can be a flat rate per trade or a percentage of the trade’s value. For example, if a client buys $1,000 worth of stock and the commission rate is 1%, the brokerage firm would earn $10 from that trade.

This system fell apart with the introduction of discounted brokerage. Yes, new firms started offering discounts on commissions to outrank their competition.

And with modern mobile applications, we reached a point of no return: zero commission trades. Thank Robinhood for that techno-revolution.

1. What is a Zero Commission Broker/Commission-Free Broker?

A zero-commission broker, also known as a commission-free broker, is a brokerage firm that does not charge commissions for executing trades. Instead, zero-commission brokers earn revenue through other means, such as interest on cash balances, payment for order flow, and premium features.

Commission-free trading offers several benefits for you, the investor. It lowers the barrier to entry for new investors. It also encourages more frequent trading, as investors can trade small amounts without being deterred by commission fees.

Some popular brokerage firms that offer commission-free trading include Robinhood, Webull, and SoFi Invest.

2. Commission-Free Trades Aren’t Always “Free”

When you place a zero commission trade with a brokerage, the firm may still charge other fees, such as regulatory fees, exchange fees, and clearing fees. These are typically passed on to the investor, although they are generally lower than traditional commission fees.

For example, when you place a trade on Robinhood, you are not charged a commission fee. However, Robinhood earns revenue through order flow.

This means Robinhood routes customer orders to market makers who execute the trades on their behalf. In return, Robinhood receives a small payment from the market maker for directing the order to them.

“Payment for Order Flow” is quite a controversial method. On one hand, it has allowed platforms like Robinhood to offer commission-free trading. And on the other, it’s been heavily criticized for (potentially) compromising trade execution quality.

How do brokerages make money if not through commissions?

Reportedly, these zero commission firms earn over 90% of their revenue from sources other than commissions. There are seven major ways in which brokerages can make money. Let’s dissect each of them.

1. Interest on Cash Balances

Your brokerage may place your uninvested cash in a money market fund or other low-risk investment. They earn interest on these cash balances from your brokerage accounts.

Interest rates on uninvested cash in brokerage accounts are typically lower than what you would earn in a traditional savings account. For example, Charles Schwab offers an interest rate of 0.01% on uninvested cash in brokerage accounts as of April 2024, while the national average for savings accounts is around 0.06%.

If you think this isn’t big enough, think again. According to the reports from 2019, 57% of Charles Schwab’s revenue comes from net interest.

2. Payment for Order Flow (PFOF)

If you have been reading this article without skipping, you already know what order flows are.

PFOF is when brokerage firms receive payment from market makers for directing customer orders to them for execution. Market makers are firms that facilitate trading by buying and selling securities.

Market makers pay brokerage firms for the opportunity to execute customer orders because it allows them to profit from the bid-ask spread—the difference between the price at which they buy and sell securities.

So you can see why there’s a huge debate around conflict of interest.

Read More: Setting Up Alerts in TradingView – Pop-up, In-App, Email and More

3. Margin Trading

Margin trading allows investors to borrow funds from their brokerage to buy securities, using their existing investments as collateral. This is called buying on margin.

Brokerage firms charge interest on the borrowed funds. This interest is the margin rate and is typically higher than the interest rates for uninvested cash balances.

Margin trading can be risky, as it amplifies gains and losses. If the value of the securities purchased on margin decreases significantly, you (the investor) may be required to deposit additional funds to cover the losses, known as a margin call.

4. Asset Management Fees

Some brokerage firms offer managed portfolios where they actively manage investments on behalf of their clients. They charge a fee for these services, typically based on a percentage of the assets under management (AUM).

The fee covers the costs of managing the portfolio, including research, analysis, and trading. The fee structure may vary depending on the level of service and the complexity of the investment strategy.

5. Premium Features

Brokerage firms offer additional services or features for a fee. These may include access to advanced trading tools, research reports, and educational resources.

For example, E*TRADE offers premium features such as access to professional research and analyst reports, for a monthly fee. These features are designed to provide added value to customers willing to pay for them.

6. Advertising and Partnerships

Brokerage firms also generate revenue through advertising and partnerships with other financial institutions. They promote financial products and services to their customer base in exchange for a fee.

For example, a brokerage firm may partner with a credit card company to offer a co-branded credit card to its customers. The brokerage firm earns revenue through card fees and interest charges.

7. Wrap Fees

Wrap fees are a fee-based account where the brokerage charges a single fee that covers investment management, brokerage, and other advisory services.

The fee is typically a percentage of the total assets under management and can vary based on the level of service provided.

Wrap fee accounts are often tailored to meet the investor’s specific needs and may include personalized investment advice and portfolio management.

In conclusion, you don’t really need to worry about your brokerage firm. They’re earning their piece of the pie already.

The real question is, should you be using their services?

Risks of zero-commission trading: Should you be trading commission-free?

Make no mistake: you are paying for the trade-off in some way or another, especially if you’re a beginner.

1. Subpar Execution Quality

Some commission-free brokers may prioritize routing customer orders to venues that pay for order flow, which is the whole debate around order flows that we discussed earlier.

This means your trades might not always get the best execution price.

According to a study by the SEC, due to order routing practices, retail investors may receive prices inferior to the national best bid and offer (NBBO). This can affect you in two major ways:

- Opportunity Cost: Brokerages that focus on saving money will deal with market makers that earn them the most. Lack of focus on the quality of trade execution can cost you big opportunities as your brokerage might not be able to fill your order on a highly volatile stock at the right time.

- Slippage: The small trade fee that these zero commission brokerages offer to save sometimes dwarf in front of slippage in offer price. If you’re buying 10,000 shares of a stock, even a $0.01 difference in your fill price can save (or cost) you an extra $100.

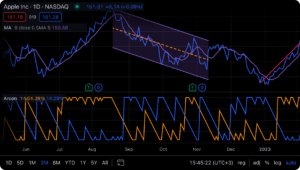

2. Lack of Advanced Trading Tools

Commission-free brokers usually offer basic trading platforms that lack advanced features like technical analysis tools, real-time market data, and customizable trading interfaces.

Although we may have a solution for that if you really want to use a commission-free broker. After all, Zeiierman is the future of trading indicators across the board.

3. Usually Inferior Customer Service

Brokers offering commission-free trading may prioritize cost savings, leading to less investment in customer service. This could result in longer response times and less personalized support.

If you encounter a technical issue with your account or have a question about a trade, you may have to wait longer for assistance or receive a less thorough response.

Read More: How to identify the end/start of a trend?

4. Risk of Overtrading Among Amateurs

This is the biggest issue among beginners. The ease and low cost of commission-free trading tempt beginners to trade more frequently than necessary, leading to higher trading costs and potential losses.

A study published in the Journal of Finance found that novice traders who traded frequently underperformed the market by an average of 6.5% annually.

Read the greater fool theory if you haven’t yet.

5. Hidden Fees

Explanation:** While trades may be commission-free, some brokers may charge fees for other services, such as account maintenance, inactivity, or transferring funds.

6. Bad for Active Day Traders

As a day trader, you must execute trades quickly to take advantage of short-term market movements. However, the lack of advanced tools and slow execution speeds on commission-free platforms could hinder your ability to trade effectively.

Enhance Your Trading Strategy with Ultimate Indicators

Now that you’ve gained insights into zero-commission trading and understood the risks, it’s time to elevate your trading game.

Accurate analysis is key to making informed trading decisions. Whether you’re a beginner or an experienced trader, having the right tools can make all the difference. This is where Zeiierman’s trading indicators come in.

Don’t take my word for it. Check out some of our free indicators and see for yourself.