As a strategy, day trading with leverage can certainly amplify your trading power. But it also amplifies your risk just as much, if not more.

Imagine you have $1,000 in your trading account, and with 2:1 leverage, you could control $2,000 worth of assets.

Hypothetically, if you were to make a trade with 50% profit, you would have $2000 in your trading account after returning the $1000 you took as leverage. Awesome, right? But what if your trade’s price fell by 50% instead?

In that scenario, you would be left with $0 after returning the leveraged amount. Being able to trade with leverage is both a boon and a bane; the trader’s expertise and experience make the difference.

What is day trading with leverage?

Day trading with leverage lets you use a margin account provided by your broker. This account allows you to borrow funds to trade, effectively increasing your buying power. However, this also means you must adhere to your broker’s margin requirements and manage the risk of potential margin calls.

Over-leveraging can lead to significant losses, and the pressure of trading with leverage can affect your decision-making. That’s why it’s crucial to have a solid risk management strategy in place. But we’ll discuss proper risk management in detail, so don’t start worrying.

How to Day Trade with Leverage?

To day trade with leverage, you’ll first need to open a margin account with a brokerage that offers leveraged trading. Once your account is set up and funded, you can use leverage to amplify your trading power.

Here’s how it works:

1. Margin Accounts: A margin account is a brokerage account that allows you to borrow funds from your broker to trade financial assets. This borrowed money increases your buying power, allowing you to control larger positions than you could with just your own capital.

2. Margin Requirements: Brokers have specific margin requirements that you must meet to trade on margin. These requirements dictate how much of your capital you need in your account relative to the size of the trade you want to make.

For example, if your broker offers 4:1 leverage, you need $1,000 in your account to trade $4,000 worth of stock.

3. Placing a Leveraged Trade: Once you have everything set up, you can place a leveraged trade. This involves selecting the asset you want to trade, specifying the amount you want to trade, and choosing the leverage level you want to use.

Note: Remember that higher leverage levels amplify gains and losses.

4. Managing Risk: Trading with leverage increases risk. To protect your capital, you should have a solid risk management strategy. This may include setting stop-loss orders to limit potential losses, using proper position sizing, and avoiding over-leveraging.

For your convenience, we have a free tool for risk management that you can use right away.

5. Monitoring Your Trades: When trading with leverage, monitoring your trades closely is essential. Market conditions can change rapidly, and leveraged trades can result in significant losses if not managed properly. Stay informed about market trends and be prepared to act quickly if necessary.

6. Closing Your Trade: Once you’ve achieved your trading goals or if the market moves against you, it’s time to close your leveraged trade. It involves selling the asset you bought or buying back the asset you sold to close your position.

Pro Tip: Make sure to review your trade and learn from both your successes and mistakes. It’ll hurt like a b*tch if you’re a beginner, but the data will give you an unforgettable lesson for the next trade.

Seriously though, if you’re just learning the ropes, I cannot stress enough how much leverage can amplify your risks. Do be careful and be absolutely sure what you’re doing. Use **some of our free indicators** to double-check your trade decisions, and you’re good to go.

Pros of Day Trading with Leverage

- Potential for Higher Returns

As we have discussed, day trading with leverage can significantly increase your profits on successful trades. By amplifying the buying power, you can control larger positions and potentially earn greater profits than if you were trading with you capital alone.

Suppose you have $1,000 in your trading account and use 2:1 leverage. With leverage, you can control a $2,000 position. If the stock price increases by 10%, you would earn $200 instead of $100 without leverage.

- Increased Trading Opportunities

Leverage provides access to more trading opportunities than possible with only your capital. You can take advantage of short-term price movements in a wide range of assets, which lets you diversify trading strategies and potentially increase profits.

Example: Without leverage, you might only be able to trade a few stocks. You can trade various stocks, commodities, or currencies with leverage depending on your broker’s offerings.

- Ability to Diversify

With leverage, you can spread capital across multiple trades, reducing the risk of concentrating all your funds in a single trade. Diversification can help mitigate risk and protect against losses in any single position.

Example: Instead of investing all your $10,000 in a single stock, you could use leverage to trade $40,000 worth of stock and diversify your investments across four different stocks, thereby reducing your overall risk.

Cons of Day Trading with Leverage

- Increased Risk of Loss

One of the biggest drawbacks of day trading with leverage is the increased risk of loss. While leverage can amplify gains, it can also magnify losses, leading to potentially significant losses if trades do not go as planned.

Example: If you have $10,000 in your account and use 4:1 leverage to trade $40,000 worth of stock, a 10% decrease in the stock price would result in a $4,000 loss, wiping out 40% of your initial capital.

- Margin Calls

When trading with leverage, you must maintain a minimum amount of equity in the account, known as the margin requirement.

Suppose a trade moves against you, and the account balance falls below the margin requirement. In that case, you’ll receive a margin call, requiring you to deposit additional funds to meet the margin requirement or close the position.

Example: If you have $10,000 in your account and use 4:1 leverage to trade $40,000 worth of stock, you may receive a margin call if the value of the stock falls below a certain level, requiring you to deposit more funds to cover the potential losses.*

- Psychological Impact

The pressure of trading with leverage can lead to emotional decision-making and impulsive trades. Beginners are more prone to making irrational decisions, such as holding onto losing positions for too long or overtrading, which can increase the risk of losses.

Risk Management Strategies for Day Trading with Leverage

- Setting Stop-Loss Orders: A stop-loss order is a predetermined price at which you will exit a trade to limit your losses. This is an amazing tool that triggers as soon as a trade moves against you by breaking the support or falling short of the resistance.

- Using Proper Position Sizing: Proper position sizing is essential when trading with leverage to avoid overexposure to risk. Determine the maximum amount you will lose on a trade and adjust your position size accordingly.

- Avoiding Over-Leveraging: While leverage can amplify profits, it can also increase the risk of significant losses. Avoid using excessive leverage that could lead to a margin call or wipe out your trading account.

- Staying Informed: Stay informed about market trends, news, and events that could impact your trades. Being aware of potential risks can help you make more informed trading decisions.

- Practicing Discipline: Stick to your trading plan and avoid emotional decision-making. Fear and greed can lead to impulsive trades that may result in losses. Stay disciplined and follow your risk management strategies.

- Make Practical Decisions: Gather data to understand the trade and the commodity. You should also use trading indicators like these to help you make an informed decision.

Here are two amazing risk management tools you should try out:

How to Get Leverage for Day Trading?

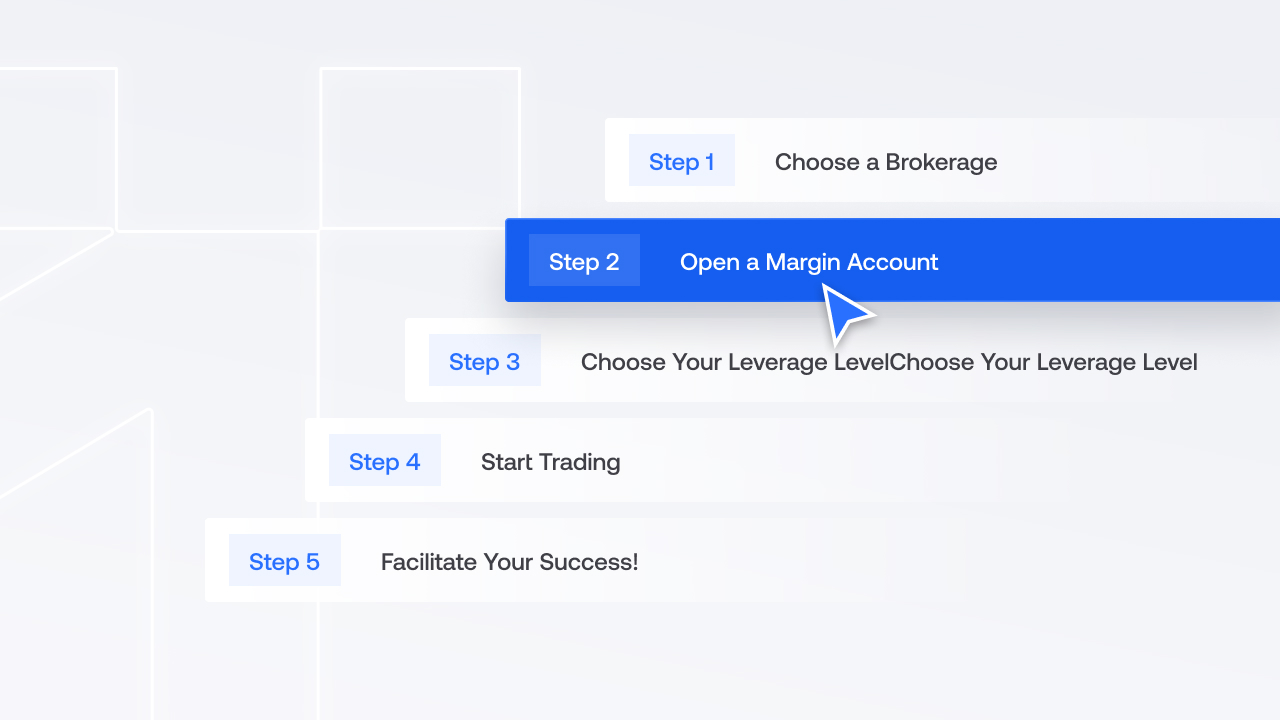

To get leverage for day trading, you’ll need to open a margin account with a brokerage that offers leveraged trading. Here’s how it works:

Step 1: Choose a Brokerage

Look for a brokerage that offers leveraged trading and meets your trading needs. Consider factors such as leverage options, trading platforms, fees, and customer support.

Step 2: Open a Margin Account

Once you’ve chosen a brokerage, open a margin account. You must meet the broker’s minimum deposit requirements and provide the necessary documentation to verify your identity.

Step 3: Choose Your Leverage Level

Make the required initial deposit to fund your margin account to serve as collateral for your leveraged trades. Decide how much leverage you want to use for your trades.

Be mindful of the risks associated with higher leverage levels, and choose a level that aligns with your risk tolerance and trading strategy.

Step 4: Start Trading

It’s time to place your bets and monitor them closely.

Remember, leverage is an amplifier. It can amplify your losses just as much as your gains. Don’t over-leverage yourself by trading emotionally.

Step 5: Facilitate Your Success!

To increase your likelihood of success, make sure to use the best tools available, subscribe to our indicators here: Zeiierman Indicators.