Institutions are hedge funds, funds, banks, pensions, insurance companies, etc., responsible for managing hundreds of billions of dollars. These firms account for over 75% of all trading volume.

Their positions move the market, not retailer traders’ (you and I). Executing large volumes in any market will impact the current and future price moves. Institutions drive strong trends. It makes sense to follow their footprints and, even better, buy and sell before they do.

Let’s better understand how this works and how we can utilize it in our trading.

First, institutions have access to enormous resources/information/insights, and talent that no other trader will ever come close to having. Hence, they have a big advantage over the crowd.

Their research budget and the ability to attract the brightest minds from all over the world make them always ten steps ahead in finding new ways to profit from the market.

They simply have the power and knowledge to create strategies and execution models that can move an entire market. We must accept that fact and embrace it in our own trading.

Let’s talk about their trading strategies.

I have worked at a fund and know what’s happening under the hood.

I know and have seen it myself; some strategies are very simple in terms of the rational rules that the strategy follows. It can be easy and well-defined concepts that we all know about, what makes a big difference is the way the strategy is executed. When we talk about executing large volumes, new aspects come into play that totally take a simple base strategy into a complex and sophisticated algorithm.

The cost of carrying out their business

Imagine making thousands of transactions with large volumes? Hence, there is a big advantage to come up with executing- models that aim to execute trades as cheaply as possible. So trading firms/institutions spend enormous resources forecasting the future volume, future price moves, and their impact on the market. All these factors together will determine when and at what price they will buy or sell according to their base strategy.

In addition, the firms do not want to expose their trading strategies, so the challenge is to act/execute so that it is not visible how they think. To execute large business volumes without them being too clear to other players is a big challenge.

So, on top of their base strategy, institutions have models that determine when and at what price they can execute trades, combined with models that only focus on hiding their impact.

Since, once again, it’s very challenging to execute large volumes in a market without having an impact. If a strategy clearly impacts the market, it can be traced and detected by other firms.

3 aspects that institutions care about

#Strategy

The base strategy can be simple regarding their concepts and mathematical models. It can be a well-known indicator and method.

#How to Execute Trades

Executing large volumes in a market can take time and involves many aspects, such as current and future volume/liquidity/volatility, etc. They forecast these aspects to know when the algorithm is likely to get the price they want without moving the market too much.

#How to Hide the Impact

A pressing concern is that their strategy shall be exposed by other firms since it can be difficult to completely hide their impact. So they have models that estimate and forecast when and to what price their impact is as low as possible. High liquidity and volatility is a key measure.

However, even though they try to do what they can to hide their strategies, their size and large positions can take weeks or even months to accumulate, therefore, it becomes almost impossible for them to fully hide their tracks. Fortunately, this makes it possible to identify what they are buying well before they are finished accumulating a position.

Why do they accumulate/distribute a position so long? Naturally, they can only buy/sell large volumes when the market allows them to. They must find spots to access high liquidity. High liquidity allows them to hide their tracks better. Since they can buy/sell at a price zone without moving the market too much.

Apply the knowledge

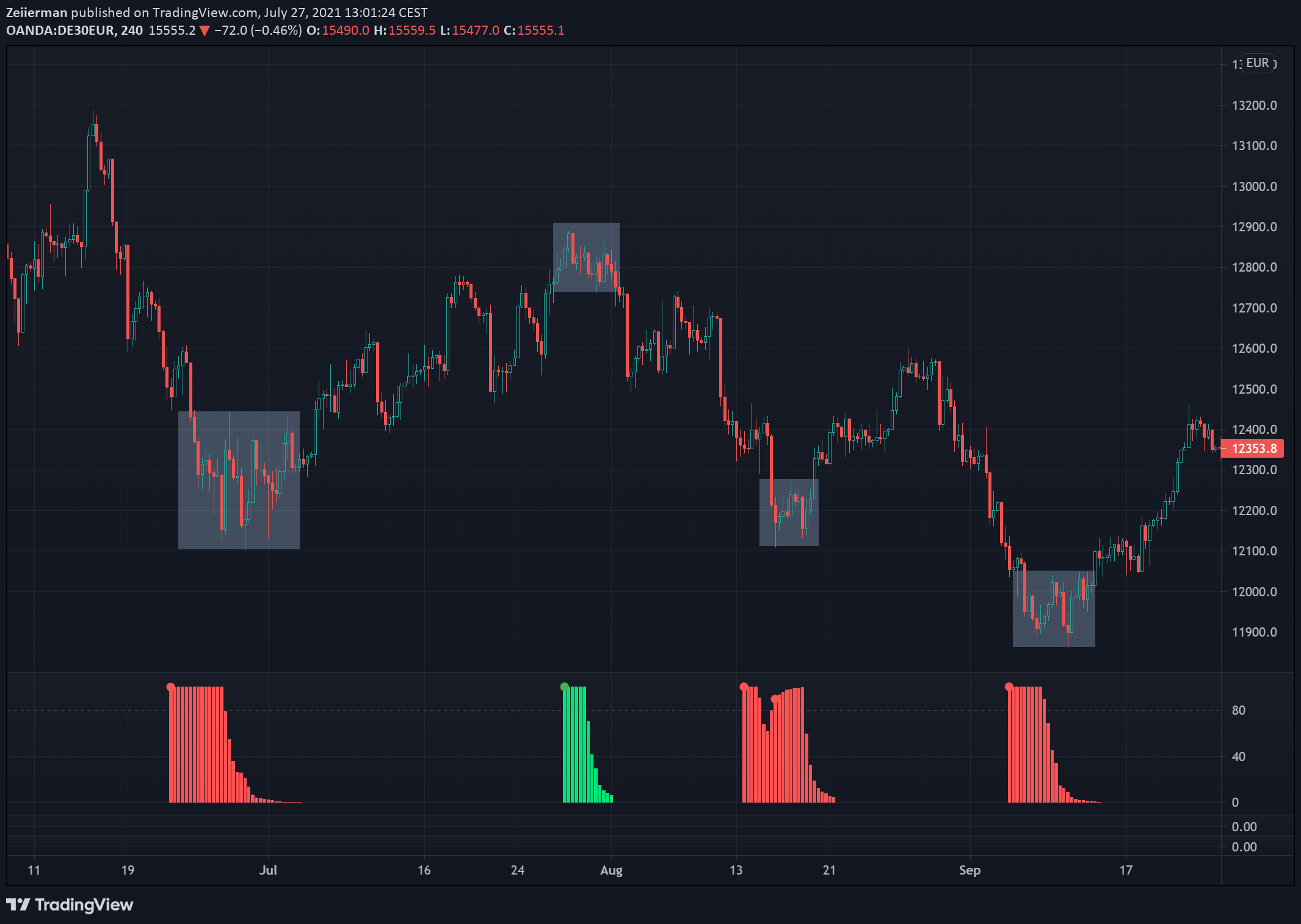

With this knowledge about how institutions function, we can find areas where we have liquidity runs, large volume spikes, and accumulation/distribution around market zones.

What we traders can do is to watch the market, analyzing where liquidity runs have taken place, and where large volume has occurred. Draw market levels based on where the price has made significant price moves and create scenarios of what may happen in these areas.

Remember that it takes a very long time for institutions to accumulate a full position, so we don’t have to stress about entering our positions; rather analyze and watch what the market does and then act accordingly.

Make sure you have a good understanding of Strong Trends and how you can identify the start and end of trends.

Institutional Pattern indicator

Use our Institutional Pattern indicator to find areas where Institutions accumulate and distribute large positions. Use our Institutional Trading Strategy on Tradingview!