Starting your trading journey can feel like setting sail on vast, uncharted financial waters. Trust me, I have been there. There’s so much to learn and do, which makes learning far more convoluted than it should be.

Should you start with stocks, futures, or something else entirely? More importantly, which broker should you choose?

Here’s another kicker: what should you use for your chart analysis?

At Zeiierman Trading, we’ve been navigating these waters long enough to know that the right tools aren’t just helpful—they’re essential. As such, I am tackling all the questions a beginner such as yourself might have.

Today, we’re starting with the platform you should choose for TA (technical analysis). It’s no surprise that TradingView is our go-to choice. After all, SM_Trader and I publish all of our indicators there only. And there’s a good reason for that.

TradingView is an excellent platform for beginners. Its intuitive interface and educational resources make it easy for new traders to learn the ropes of technical analysis. TradingView’s free plan provides all the essentials—including basic indicators, real-time data for select markets, and a single chart layout—making it a perfect starting point for new traders.

With additional features like paper trading for practice, customizable charts, and a thriving community (that includes us, Zeiierman and SM_Trader), beginners can build their skills without feeling overwhelmed.

That said, it’s not for everyone. Let’s see if you’re the right fit for TradingView. And, if not, where else should you be looking?

Quick Overview of TradingView

TradingView was started in 2011 to provide a user-friendly, web-based charting tool for traders of all levels. Over the years, it has transformed into much more – a global hub where traders and investors collaborate/chat to analyze the markets, share their insights, and enhance their trading skills.

What started as a simple charting tool has become an indispensable resource for over 90 million traders worldwide.

Why is a simple charting platform so popular, you ask? Because of its hybrid nature – whether you’re a day trader or a long-term investor, TradingView has something to offer.

For beginners, it’s an entry point into the world of trading with an easy-to-use interface and abundant educational resources. For the experienced, it’s a deep well of data and advanced functionality that can be tailored to complex strategies.

Why is TradingView the best charting tool for beginners?

TradingView is tailor-made for beginners once you’re through the door and have gotten accustomed to the basics of this charting platform. But you don’t have to take my word for it. I know you must think, why is TradingView the go-to platform for so many trading newbies? There are alternatives like Meta Trader, right? Let’s break it down.

1. User-Friendly Interface

Let’s be real for a second. If you’re new to trading, most platforms feel like stepping into a cockpit without flight training. Charts, candlesticks, indicators — it can all look like a foreign language. TradingView fixes that through its clean, intuitive, and customizable interface.

One of the biggest reasons TradingView is SO worth it for beginners is that you won’t spend hours figuring out dashboard navigation and the basic tools. Everything you need is laid out logically, and the platform practically invites you to explore.

The platform’s drag-and-drop functionality, zooming, and easy-to-access tools make analyzing charts feel less like a game instead of a chore. Plus, it doesn’t overwhelm you with technical jargon—you can start simple and work your way up.

The customizability of your dashboard is such that it grows alongside you. It’s beginner-friendly, yes, but it’s also designed for growth. As you get more experienced, you’ll find that TradingView offers more advanced tools that go hand-in-hand with your newly learned tactics.

And the biggest pro for me is that they have iOS and Android applications. TradingView’s cloud-based system ensures that your saved charts and settings are available on any device—laptop, phone, or tablet. Trading on the go? No problem.

2. Educational Resources

We say this to all the beginners here at Zeiierman. Trading isn’t just about numbers and lines on a chart. It’s about understanding why the market moves the way it does. TradingView gets that. It’s not just a platform—it’s a teacher.

Community Wisdom: TradingView’s social features let you chat with and see trade ideas, strategies, and analyses from experienced traders. As a beginner, you’ll learn a lot by being a part of the community and learning from top creators and traders. For example, our analysis of indicators and financial research papers is often promoted in TradingView‘s editor picks section. And thousands of amazing and helpful traders are on the platform, just like SM_Trader and I.

Step-by-Step Tutorials: TradingView offers guides for practically everything—from drawing trendlines to understanding Fibonacci retracements. The best part? These resources are easy to find and designed for beginners.

Interactive Discussions: Got questions? Jump into a discussion thread. The TradingView community is incredibly active and welcoming, making it easy for newcomers to ask questions and learn without judgment. And if you’re still confused, you can always get in touch with me or join our Zeiierman Trading community via Discord.

3. Free Access to Essential Features

One doesn’t even need to buy a subscription to use TradingView. That’s what makes it a no-brainer for beginners.

The free plan gives you access to:

- One chart layout (more than enough to start).

- Up to three indicators per chart.

- Access to community ideas and public chats.

- Real-time market data for select exchanges.

Of course, TradingView’s plan has its limits, and you don’t get access to everything.

Traders on TV’s free plan get fewer alerts, can’t save multiple chart layouts, and might not have real-time access to all markets. But honestly? As a beginner, these aren’t deal-breakers. The free plan gives you plenty to learn and grow with. Once you’re ready for more, you can explore their paid plans.

Real-time data for specific markets is included, which is a big win for beginners. You’ll need to upgrade or buy data add-ons if you want global, comprehensive, real-time data. But that’s something you can consider when you’re further along in your journey.

Is TradingView Good for Day Trading?

Day trading is all about seizing opportunities in real time—spotting those breakout moments, understanding rapid market shifts, and acting quickly.

TradingView is great for day trading. It provides the speed, flexibility, and insights that day traders need to succeed in a fast-moving market. Whether you’re scalping small price moves or riding intraday trends, TradingView provides the tools to make it happen.

1. Custom Alerts That Keep You Ahead: With features like alerts for price levels, trendline breaks, and even custom conditions tied to indicators, you’re never out of the loop. Imagine you’re tracking a stock that’s nearing a critical resistance level.

You’re away from your desk, but TradingView’s alert system will notify you when the price crosses your threshold. And the best part? You can set EVERY possible alert you can think of. Phone? Supported. Email? Supported. API calls and webhooks? Yes, TradingView supports those as well.

2. Lightning-Fast Real-Time Data: You can access real-time data for many markets, even on the free plan. Knowing when a stock breaks out or reverses can be the difference between profit and loss during volatile trading hours.

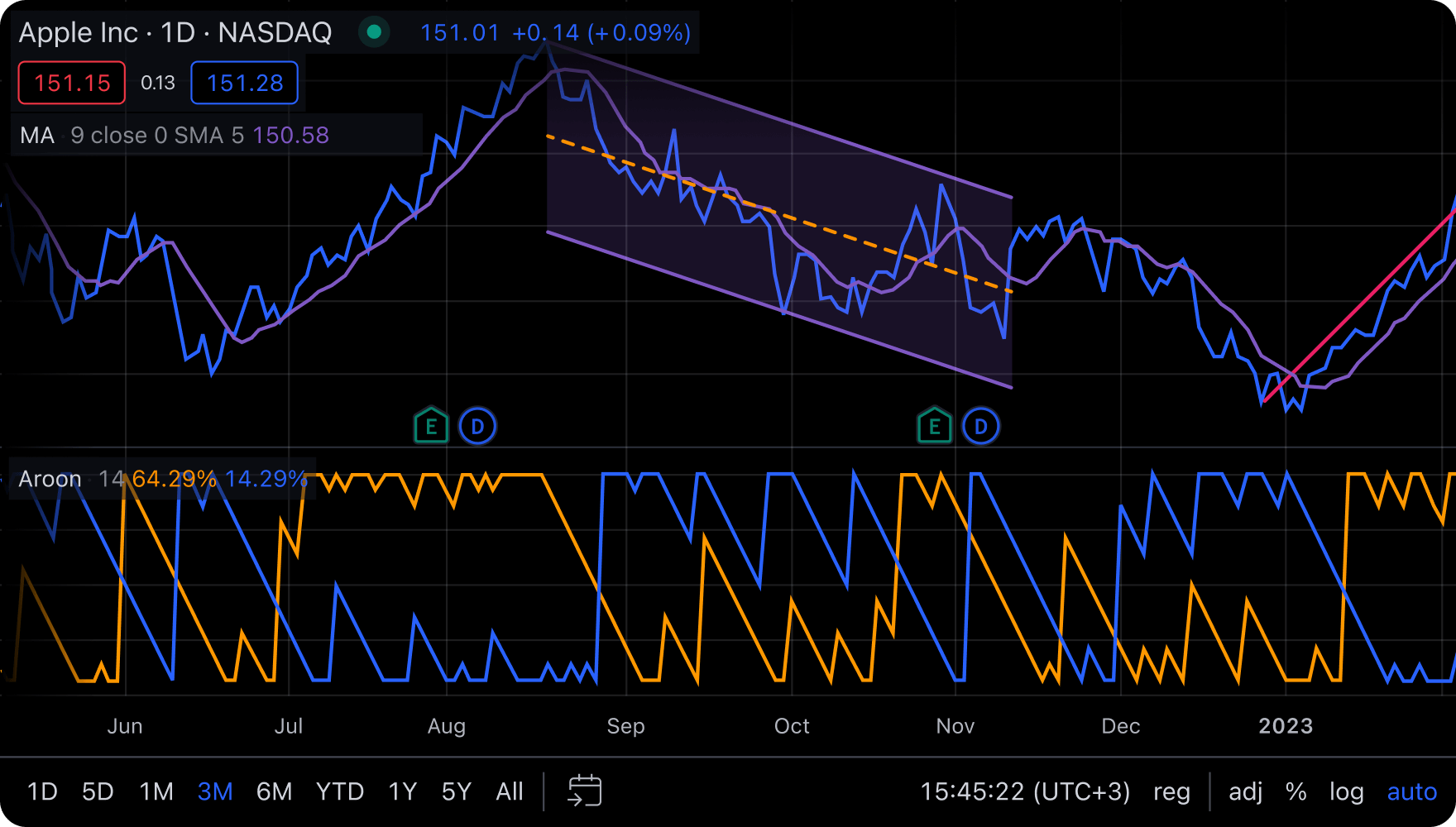

3. Comprehensive Analysis Tools: Day trading requires precision, and TradingView’s charting capabilities deliver. With hundreds of built-in indicators such as Moving Averages, Bollinger Bands, and RSI, you can craft strategies tailored to your trading style.

The Pine Script functionality allows advanced users to build custom indicators. Or even better, you can use the indicators we have custom-built for you at Zeiierman Trading.

4. Multi-Timeframe Analysis for Granular Insights: Day traders must juggle multiple timeframes to confirm trends or fine-tune entry and exit points. TradingView helps you do that.

5. Community-Driven Insights: Even seasoned day traders can’t keep up with everything, so TradingView’s community is invaluable. Professionals and enthusiasts share thousands of day trading ideas daily, allowing you to compare strategies and pick up actionable insights.

For example, SM_Trader and I frequently share real-time setups that benefit from specific intraday movements, and our followers often act on these ideas with success.

How can you benefit from all this, you ask? By following us on TradingView for all those free indicators and tidbits of trading knowledge.

Advanced Features Accessible for TradingView Users

Let’s dive into some of the advanced features available for free and paid users. It’s best to use these features once you have understood the basics of trading and gotten the hang of it.

1. Demo Trading: Importance of Paper Trading

Before diving into live markets, beginners need a safe environment to experiment, make mistakes, and learn without risking real money. That’s why paper trading is so AWESOME. And TradingView provides access to that.

Paper trading, also known as simulated trading or demo trading, allows users to:

- Practice Strategies: Test out trading strategies using live market data without the financial risk.

- Understand Market Dynamics: Learn how different assets move and react to economic events in real-time.

- Develop Confidence: Practice entries and exits until your trading approach feels second nature.

And the best part? Paper trading is absolutely free for all TradingView users.

2. Access to Comprehensive Charting Tools

One of the standout features of TradingView is its robust charting capabilities. Yeah, that sounded very salesy. But “”robust”” is the best fit here.

Many features, such as drawing tools and basic indicators, are available on the free plan. However, advanced indicators, custom timeframes, and extended historical data require a paid subscription.

From basic tools like RSI and MACD to more advanced options like Ichimoku Clouds, TradingView’s library covers it. Want to combine multiple indicators for deeper insights? You can easily overlay indicators to test theories or spot confluences. Or annotate your charts with trendlines, support/resistance levels, and Fibonacci retracements.

3. Integration with Brokers

TradingView’s broker integration feature is a game-changer for everyone, not just beginners.

Think about it. The tool you used for reading charts and technical analysis can execute trades for you. This eliminates the need to switch between multiple platforms, streamlining the trading process.

While you can do paper trading and analysis without one, you’ll need a broker to execute live trades on TradingView. TradingView partners with brokers worldwide, including popular names like Interactive Brokers, OANDA, and Forex.com. This ensures compatibility for most users.

Free or Paid? Broker integration features are free. However, your broker may charge separate fees for trading through TradingView.

4. Extended Historical Data

Analyzing historical data is essential for refining long-term strategies and spotting patterns that may repeat over time. TradingView’s paid plans lets you access extended historical data going back years, which is particularly useful for backtesting strategies over longer periods, identifying trends across different market cycles, and analyzing price reactions to past events.

This feature is available only on paid plans, making it an essential upgrade once you’re through the beginner phase and start some serious, long-term trading.

5. Multiple Chart Layouts

Paid users can unlock multiple chart layouts, enabling side-by-side comparisons of assets or multiple timeframes for a single instrument. This feature is particularly helpful for monitoring correlations between assets (e.g., stock indices vs. commodities). And to track various timeframes (e.g., 1-hour and daily charts) to fine-tune entry and exit points.

This is, unfortunately, a paid feature but one that a beginner won’t likely need. Unless you plan to be Warren Buffett from the get-go.

6. Custom Alerts with Advanced Conditions

With the paid plan, you can set up highly specific alerts tailored to your trading strategies. For example:

- Receive notifications when two moving averages cross.

- Get alerted if a candlestick pattern forms at a key support level.

7. Custom Scripting with Pine Script Pro

Paid users can take full advantage of TradingView’s Pine Script Pro to create custom indicators or automate trading strategies. With Pine Script Pro, you can automate repetitive tasks, share custom scripts with the TradingView community and build even better tools tailored to your specific needs.

TradingView’s Limitations: There’s Gotta Be Some.

As I said earlier, my opinions will be objective and unbiased. TradingView is a versatile platform, but like any tool, it comes with its limitations and considerations.

1. Learning Curve

While TradingView is designed to be user-friendly, some of its advanced features can feel overwhelming to beginners.

Tools like Pine Script Pro, multi-chart layouts, or complex indicator combinations require a deeper understanding of trading concepts.

For instance, using advanced alerts or creating custom indicators demands some prior knowledge of technical analysis and coding. As a beginner, you’ll need to rely on tutorials and community support to make the most out of these features.

2. Market Data Limitations

One common issue for beginners is the limitation of market data access, especially on the free plan. While TradingView provides real-time data for select markets, other exchanges or premium market data require additional subscriptions.

The free plan itself only includes delayed data for some global markets and real-time data for select exchanges.

3. Subscription Costs

TradingView’s paid plans unlock its most powerful features, but they come at a cost. Here’s a breakdown of the plans:

| Plan | Monthly Cost (USD) | Features |

|---|---|---|

| Free | $0 | 1 chart layout, 3 indicators per chart, basic alerts, limited data |

| Essential | $14.95 | 2 chart layouts, 5 indicators per chart, real-time data, custom alerts |

| Plus | $29.95 | 4 chart layouts, 10 indicators per chart, faster data refresh rates |

| Premium | $59.95 | 8 chart layouts, 25 indicators per chart, priority customer support |

The Free plan is the best starting point for beginners as it provides access to essential tools such as one chart layout, three indicators per chart, and basic alerts. And whenever you’re ready to trade at the big boys table, the Essential plan at $14.95 per month offers great value without overwhelming complexity.

Once you’re comfortable with the basics and ready to grow your trading skills, consider the Essential plan for its expanded capabilities, such as real-time data, five indicators per chart, and more customization options.

This gradual upgrade ensures you get the most out of TradingView without rushing into unnecessary costs or features.

TradingView Comparisons: MetaTrader & Robinhood

TradingView isn’t the only option for charting and trading. For the purposes of this article (beginner-friendly), let me show you how TradingView compares against MetaTrader and Robinhood.

1. TradingView vs. MetaTrader

| Feature | TradingView | MetaTrader |

|---|---|---|

| Usability | Web-based, user-friendly interface | Desktop-based, steep learning curve |

| Indicators | Hundreds, customizable via Pine | Dozens, scripting requires MQL4/5 |

| Community Features | Active community, idea sharing | Limited social interaction |

| Broker Integration | A wide range of brokers are supported | Depends on broker choice |

While MetaTrader is a powerful tool for forex traders, I truly believe that its complexity and lack of community features make it less appealing for beginners compared to TradingView.

2. TradingView vs. Robinhood

| Feature | TradingView | Robinhood |

|---|---|---|

| Usability | Focused on analysis and learning | Simplified for trading beginners |

| Charting Tools | Advanced, highly customizable | Basic, limited charting option |

| Costs | Free with optional paid plans | Commission-free trades |

Robinhood’s simplicity makes it great for absolute beginners focused solely on trading. However, its lack of advanced tools and educational resources puts TradingView ahead for those who want to learn technical analysis.

Now, I am not going to give you a long lecture on how to get started on TradingView from scratch. That’s because I have already done so, here you go: How to start trading with TradingView? Setting Yourself Up for Success

If you’re just starting out, I recommend you try TradingView’s free plan and explore its features with a specific strategy or goal in mind. And if you’re ready to elevate your trading experience, consider upgrading to a paid plan for access to more powerful tools.

For those looking to enhance their analysis, don’t forget to check out the premium indicators we’ve developed at Zeiierman Trading. These indicators are designed to provide actionable insights and take your trading to the next level.

Good luck, and happy trading!