Support and Resistance

Support and resistance levels are specific price points where a security tends to reverse direction. Support is the level where a price tends to find a floor as buying interest is strong enough to prevent further decline. Resistance is the level where selling pressure is enough to prevent further price increases. These levels are often identified through historical price data, where prices have repeatedly reversed, indicating psychological barriers for market participants.

Read more on how to use support and resistance here.

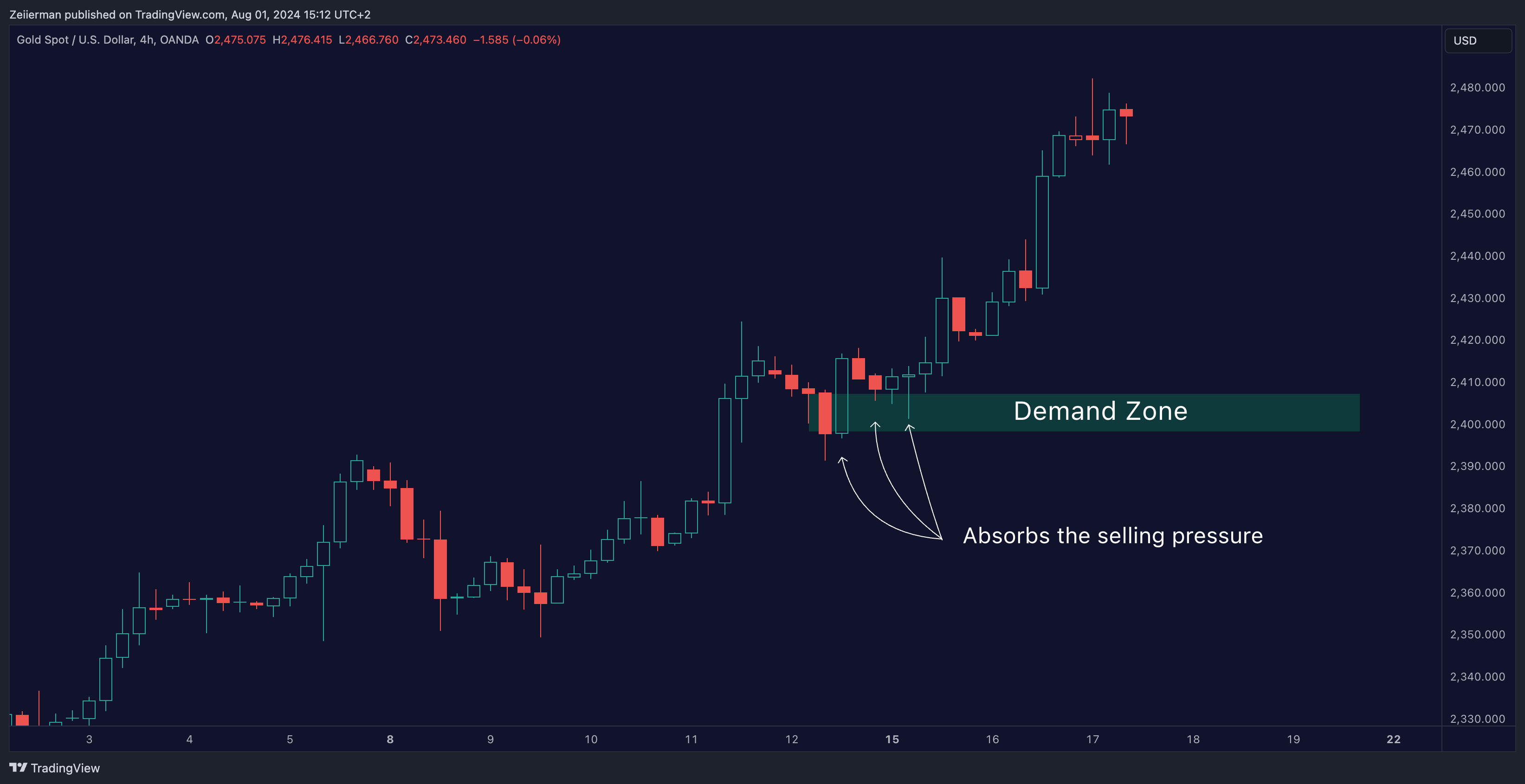

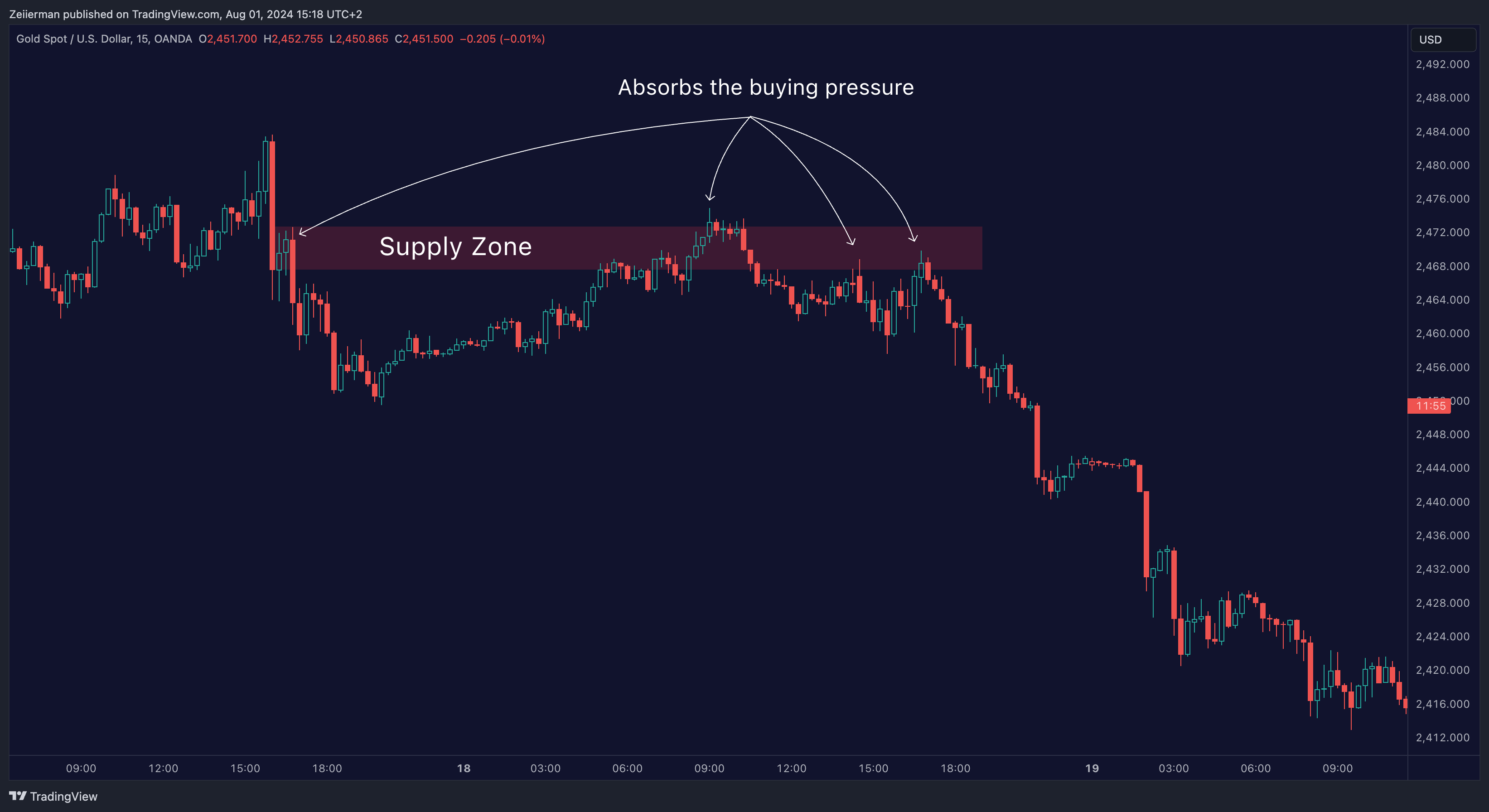

Supply and Demand

Supply and demand zones, on the other hand, are areas on a price chart where significant buy or sell orders are likely placed, causing price reversals due to market imbalances. A demand zone is a price area where buying interest is strong enough to push prices up, while a supply zone is an area where selling interest is sufficient to drive prices down. These zones are identified by areas of rapid price movement and volume spikes, reflecting significant institutional trading activity.

Read more on how to use supply and demand here.

Key Differences

- Conceptual Focus: Supply and demand focus on zones where large buy and sell orders are likely placed, causing price reversals due to market imbalances. Support and resistance focus on specific price levels where psychological barriers prevent the price from moving further.

- Identification: Supply and demand zones are identified by areas of rapid price movement and volume spikes. Support and resistance levels are identified by historical price points where the price has reversed multiple times.

- Dynamic vs. Static: Supply and demand zones are more dynamic and can change based on market conditions. Support and resistance levels are more static and are often revisited over time.

- Market Participants: Supply and demand levels are heavily influenced by institutional traders and large market participants, while support and resistance levels are influenced by a broader range of traders.

Key Benefits of Using Supply and Demand Instead of Support and Resistance

- Dynamic Nature:

- Supply and Demand: These levels are more fluid and adjust with market conditions, reflecting real-time changes in buying and selling pressures.

- Support and Resistance: These are more static and may not always adapt quickly to new market dynamics.

- Market Imbalance:

- Supply and Demand: Focus on zones where there is a significant imbalance between buyers and sellers, leading to substantial price movements.

- Support and Resistance: Concentrate on historical price levels that may not always represent current market conditions.

- Identification of Institutional Activity:

- Supply and Demand: Often highlight areas where large institutions place their orders, providing insights into significant market moves.

- Support and Resistance: Typically influenced by a broader range of traders, including retail traders.

- Trend Reversals:

- Supply and Demand: Can provide clearer signals for potential trend reversals by identifying zones with strong buying or selling interest.

- Support and Resistance: Might not always indicate trend reversals as clearly, especially if the levels are frequently tested.

- Precision in Trading:

- Supply and Demand: Provide more precise zones for trading decisions, potentially leading to better risk/reward ratios.

- Support and Resistance: Can sometimes lead to broader ranges that are less precise for making trading decisions.

- Market Sentiment Insight:

- Supply and Demand: Offer deeper insights into market sentiment by highlighting areas of strong buying or selling pressure.

- Support and Resistance: Reflect historical sentiment that may not always align with current market trends.

By leveraging the benefits of supply and demand levels, traders can achieve a more nuanced understanding of market dynamics, leading to better-informed trading decisions and potentially higher profitability.