Smart Money Concepts (SMC) trading has become a compelling approach for traders looking to gain an edge in the financial markets.

Rooted in tracking and emulating strategies used in institutional trading, the sophisticated SMC approach also delves into the subtle and underlying market movements. Its focus on analyzing real-world data, rather than relying solely on technical indicators, instills confidence in its effectiveness.

The SMC approach identifies the actions of the so-called “smart money.” These are large financial institutions, hedge funds, and other major market players with the influence and resources to move markets.

As modern markets become increasingly complex, they’re driven by high-frequency trading and sophisticated algorithms. So, following the movements of “smart money” traders helps us get unconventional returns.

I know what you must be thinking. It’s all good, but what does it mean to follow “smart money,” and how do you even do it? Let me explain.

1. SMC Trading Concepts

A. Market Structure

SMC traders ought to pay close attention to the market structure. We do so by identifying key levels where institutional traders will likely place their orders.

It includes understanding support and resistance levels, trend lines, and chart patterns that reflect the overall market cycle (accumulation, distribution, markup, and markdown phases).

B. Liquidity

Liquidity is a critical component in SMC trading. Institutional traders require substantial liquidity to execute large orders without causing significant price disruptions.

SMC traders look for liquidity pools—areas with high trading volume where institutional orders are likely to be filled. These pools are often located around stop-loss levels and key psychological price points.

C. Order Flow

By examining the buying and selling pressures in the market, traders can infer the intentions of institutional players.

For example, a surge in buy orders could indicate accumulation by smart money institutions, while a spike in sell orders might suggest distribution.

2. What makes SMC trading different from traditional trading strategies?

Traditional retail trading strategies rely on technical indicators such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). These strategies are typically based on historical price data and simple chart patterns.

While they can be effective in certain market conditions, they often fail to capture the complexity of market movements influenced by institutional trading.

In contrast, SMC trading goes beyond surface-level analysis. It emphasizes understanding the “why” behind price movements rather than just the “what.”

3. Mechanics of SMC Trading: How to Identify Market Patterns?

One of the primary methods is analyzing market structure to spot accumulation and distribution phases.

During accumulation, smart money quietly builds positions without significantly affecting the price. In the distribution phase, they offload their positions, often leading to price declines.

Another technique involves observing liquidity zones and order flow. By identifying areas with high liquidity, SMC traders can predict where institutional traders might enter or exit the market.

A. Wyckoff Methodology

The Wyckoff methodology is a cornerstone of SMC trading. Developed by Richard D. Wyckoff, it involves analyzing price and volume to identify accumulation, distribution, markup, and markdown phases.

The methodology also emphasizes the importance of support and resistance levels, trend lines, and trading ranges.

You can read about Wyckoff’s method here.

B. Volume Spread Analysis (VSA)

Volume Spread Analysis (VSA) focuses on the relationship between volume and price action to determine the strength or weakness of a market move. For instance, a wide spread on high volume often indicates strong buying or selling pressure from smart money.

C. Order Book Analysis

Order book analysis involves examining the market depth (DOM) to see the actual buy and sell orders at various price levels.

This provides real-time insights into market sentiment and potential support or resistance zones.

SMC traders use order book data to anticipate where institutional traders might place large orders, helping them align their trades with the market’s dominant force.

4. Advantages of SMC Trading

A. Higher Probability Trades

One of the main benefits of Smart Money Concepts (SMC) trading is the potential for higher probability trades.

Example: You might notice that institutional players are accumulating positions at a key support level. By entering a long position at this level, you are more likely to make a profit.

B. Better Risk Management

SMC trading inherently involves better risk management practices. By aligning your trades with institutional traders’ movements, SMC traders can set more effective stop-loss levels and take-profit targets.

C. Competitive Edge in the Financial Markets

SMC trading provides a competitive edge by enabling traders to anticipate and follow the actions of the market’s most influential participants. This edge is crucial in modern financial markets, where high-frequency trading and sophisticated algorithms dominate.

5. Challenges and Risks of SMC Trading

Potential Drawbacks and Risks

Despite its advantages, SMC trading is not without its challenges and risks. One significant drawback is the complexity of accurately interpreting market structure, liquidity, and order flow. Misinterpretation can lead to poor trading decisions and losses.

Common Pitfalls:

- Overcomplication: New traders might struggle with the complexity of SMC trading and overcomplicate their analysis, leading to decision paralysis.

- Misreading Market Signals: Incorrectly identifying accumulation or distribution phases can result in entering trades incorrectly, leading to losses.

That said, this problem can be mitigated with practice and experience. Experienced SMC traders can differentiate between genuine institutional activity and noise. This ability comes from years of observing market behavior and learning from past mistakes.

6. Zeiierman Trading’s Smart Money Concepts Indicator

At Zeiierman Trading, we have developed a cutting-edge Smart Money Concepts (SMC) indicator for TradingView that encapsulates all the essential features needed to effectively trade using SMC techniques.

Here’s a detailed look at what it offers:

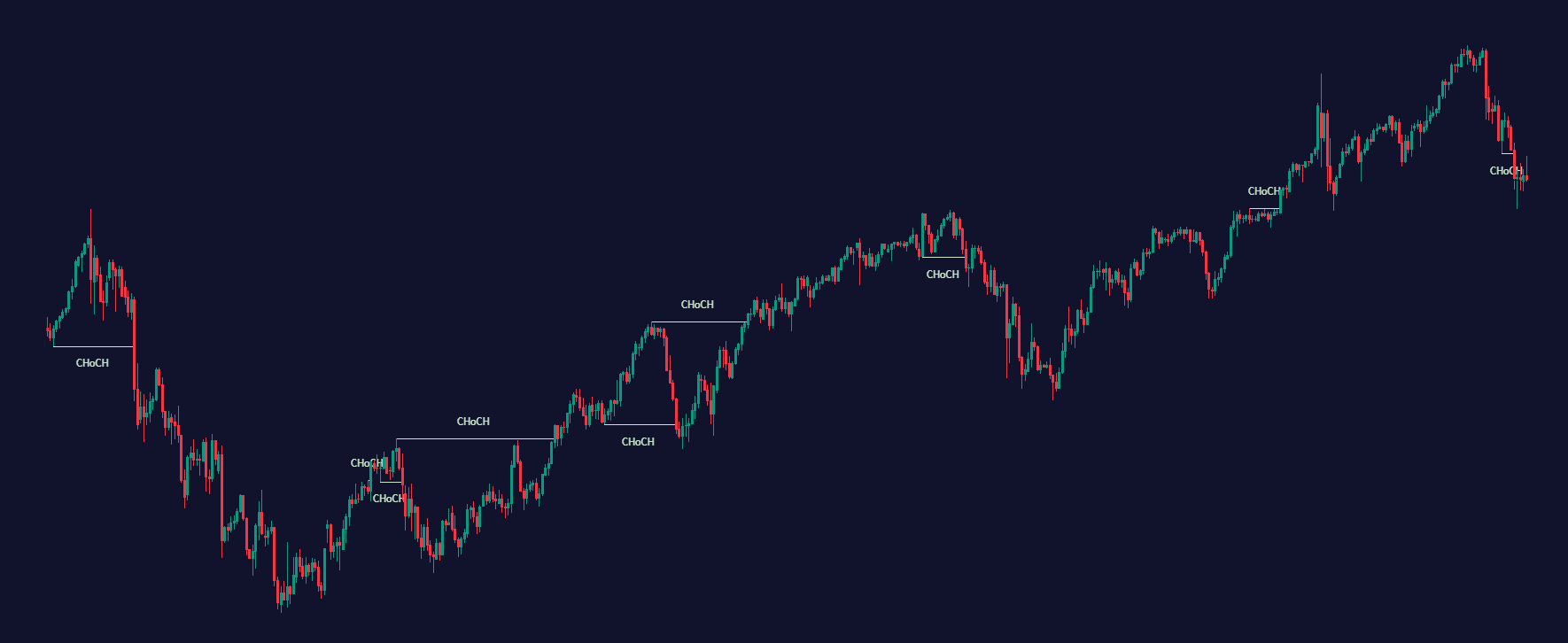

Swing Structure: The indicator automatically identifies major market structures, helping you understand the overall market direction and make informed decisions.

Current Trading Range: This feature ensures you are always aware of the current trading range. It identifies premium and discount zones within this range and updates in real time without delay.

Premium & Discount Zones: The indicator automatically identifies premium and discount zones, which is critical for determining optimal entry and exit points.

Structure Breaks: Break of Market Structure (BMS) and Change of Character (CHoCH) are automatically identified and plotted in real-time.

Supply and Demand: Our Supply/Demand indicator pinpoints high-probability trading zones, allowing you to capitalize on areas where institutional players are likely to enter or exit positions.

Settings and Customization

- Market Structure Period: Adjust this setting to fit your specific trading style and timeframe requirements.

- Real-Time Updates: Enjoy real-time updates for market structure, trading ranges, and liquidity zones, ensuring you always have the latest market information.