Prop firm trading has become increasingly popular among traders looking to leverage significant capital while minimizing personal financial risk. However, passing a prop firm challenge and securing funding requires not just skill, but a strategic approach that prioritizes risk management and high probability trades. This is where the SMC Orderblock Trend Strategy shines, offering a powerful tool for traders to meet the stringent requirements of prop firm challenges with confidence and precision.

The Perfect Strategy for Prop Firm Trading

Prop firms typically set specific criteria that traders must meet to pass their challenges, including profit targets, drawdown limits, and strict risk management rules. These requirements often prove challenging for traders who lack a disciplined approach. The SMC Orderblock Trend Strategy is ideally suited for these environments due to its focus on precision, risk management, and high win rates.

Why the SMC Orderblock Trend Strategy Stands Out

- Precision in Entry and Exit:

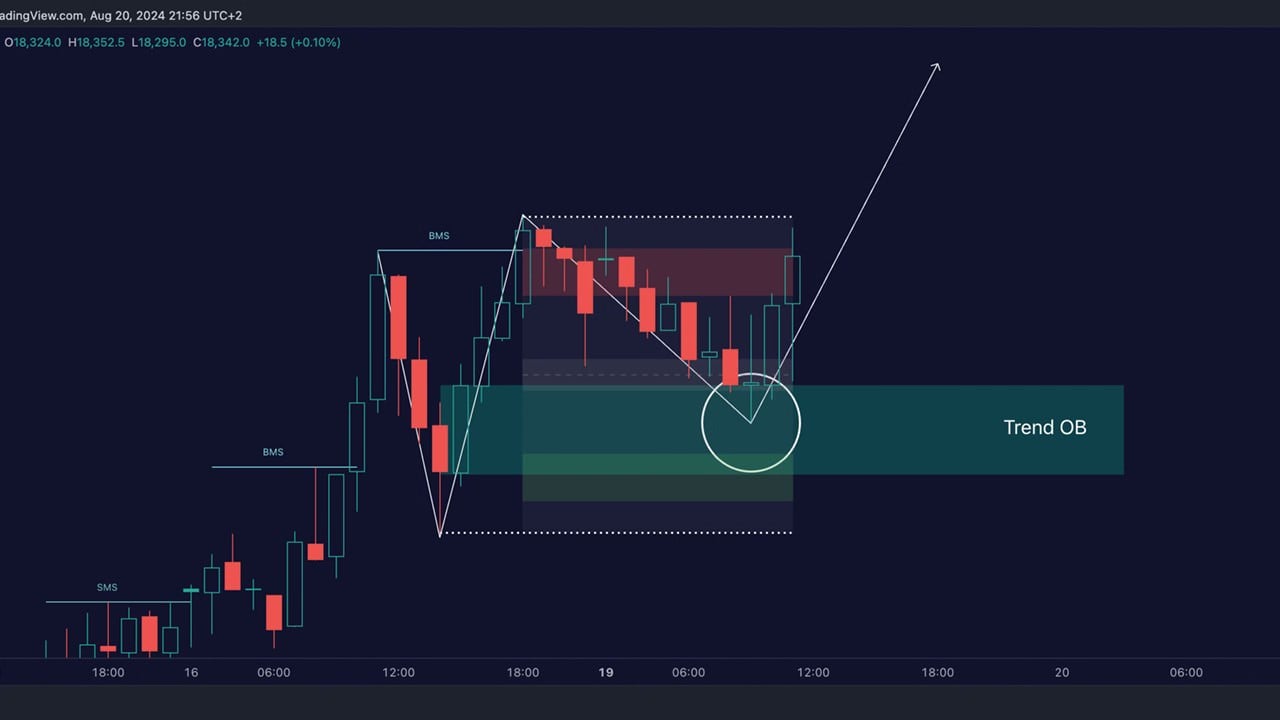

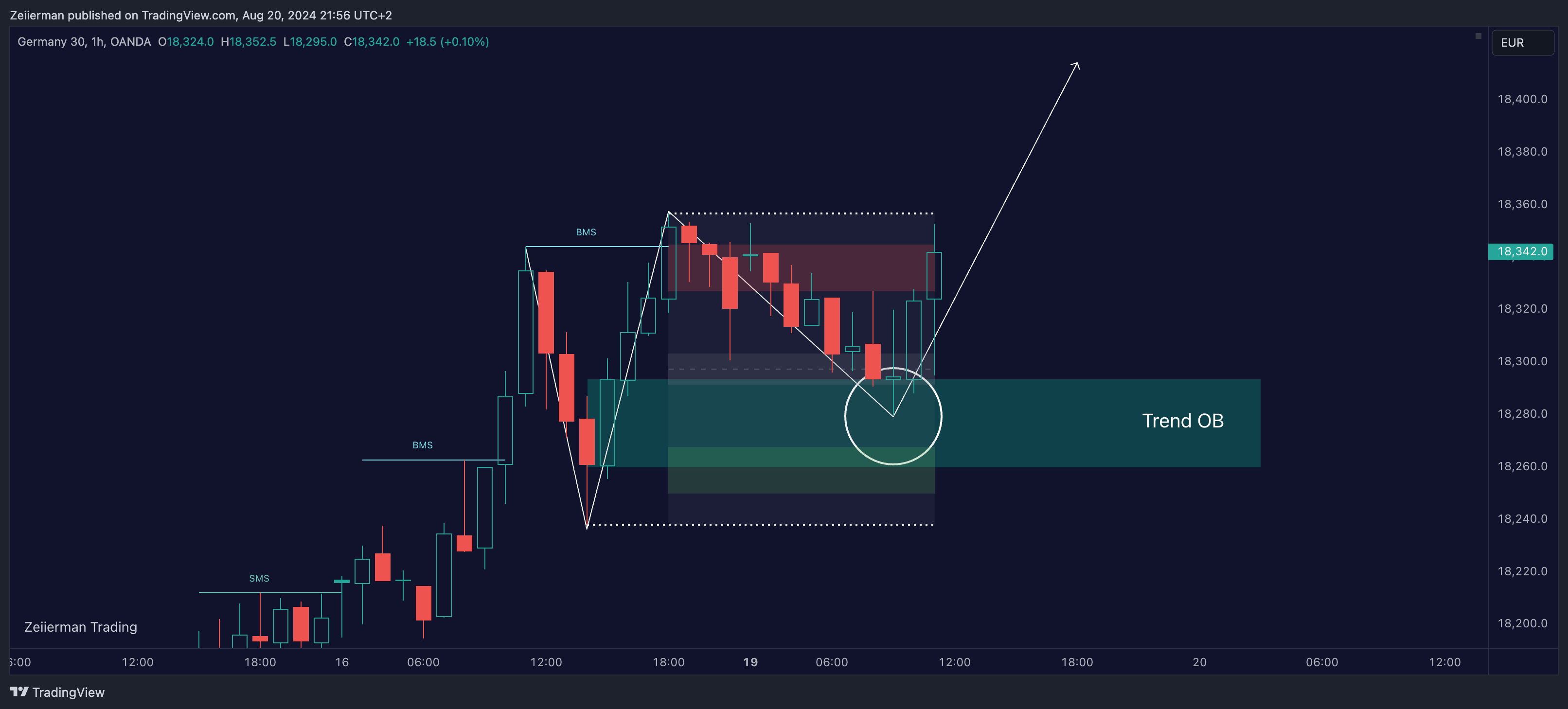

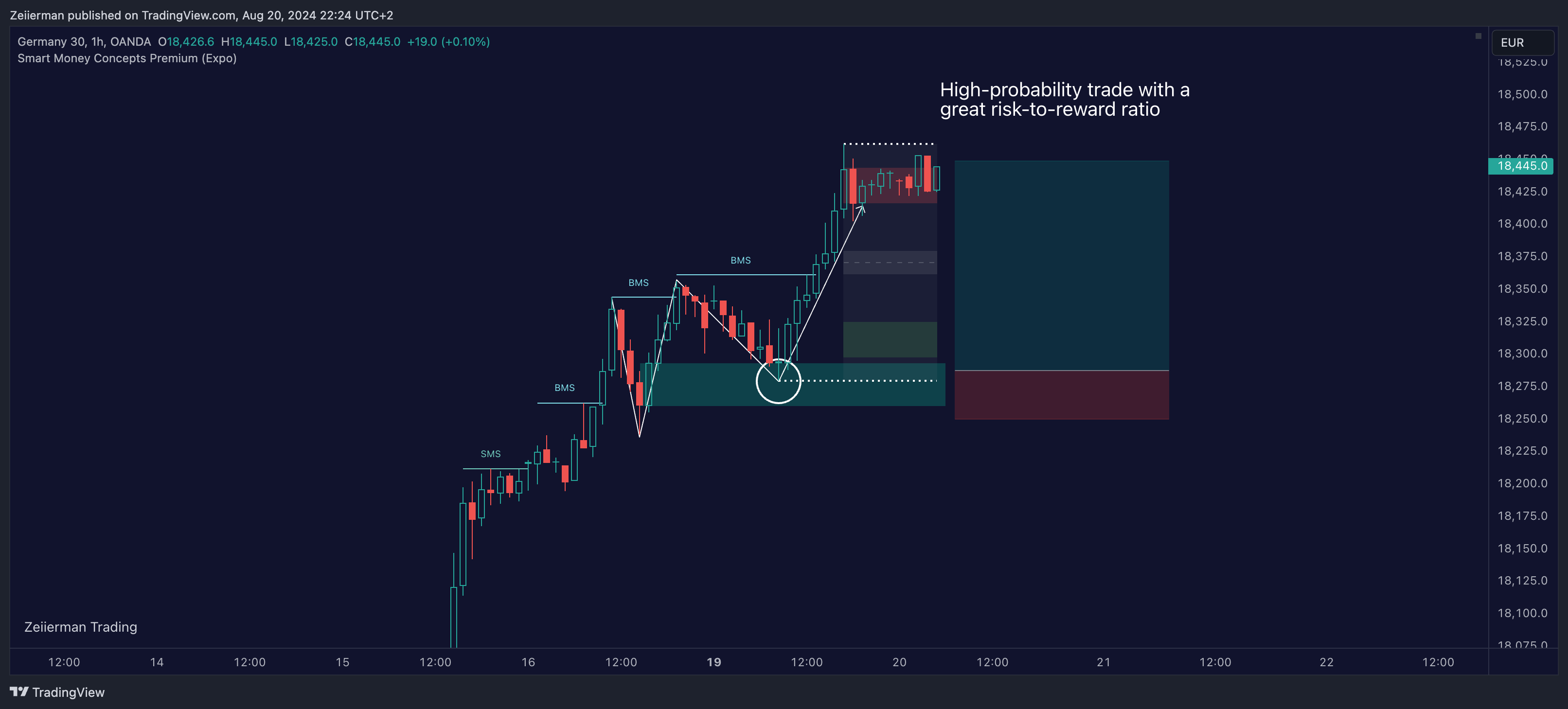

- The strategy leverages the Smart Money Concepts (SMC) framework, particularly the identification of high-probability order blocks that form after key market structures like Break of Structure (BOS) and Change of Character (CHOCH). This precision ensures that trades are entered at the most opportune moments, reducing the likelihood of unnecessary drawdowns.

- Real-Time Market Adaptation:

- Using the Premium SMC Indicator, traders can adapt to live market conditions, aligning their entries with real-time Premium and Discount zones. This real-time adaptability ensures that the strategy remains relevant even in volatile markets, a crucial factor for passing prop firm challenges where every trade counts.

- Superior Risk Management:

- Risk management is the cornerstone of the SMC Orderblock Trend Strategy. The strategy advocates for precise stop-loss placements just beyond key swing points, minimizing potential losses. Moreover, the emphasis on entering trades within narrow, defined ranges (as identified by the fractal structure) further reduces risk by avoiding trades that fall outside of optimal zones.

- High Reward Potential:

- With a focus on entering trades at the point where institutional money is likely to influence price movement, the strategy often results in trades with high reward potential. Traders can target significant price moves with relatively tight stop losses, leading to excellent risk-to-reward ratios that are essential for prop firm success.

- Consistency and High Win Rate:

- The systematic approach of the SMC Orderblock Trend Strategy ensures consistency in execution. By following clearly defined rules for identifying trends, order blocks, and entry points, traders can achieve a high win rate. This consistency is crucial for passing prop firm challenges, where steady performance over a series of trades is often more important than occasional large wins.

How This Strategy Helps Pass Prop Firm Challenges

The SMC Orderblock Trend Strategy offers several key advantages that can help traders excel in prop enterprise challenges:

- Achieving Profit Targets: By focusing on high-probability setups with excellent risk-to-reward ratios, traders can reach profit targets more consistently and efficiently.

- Managing Drawdown: The strategy’s emphasis on precise entries and tight stop losses helps keep drawdowns within acceptable limits, a critical factor in prop firm evaluations.

- Adherence to Risk Management Rules: Prop firms are stringent about risk management. This strategy’s built-in risk controls align perfectly with the strict guidelines set by most prop firms, ensuring traders remain within the allowed risk parameters.

- Building Confidence: Consistency and a high win rate build trader confidence, which is crucial when navigating the psychological challenges of prop firm trading.

Conclusion: A Winning Formula for Prop Firm Success

The SMC Orderblock Trend Strategy is more than just a trading method; it’s a comprehensive approach to trading that aligns perfectly with the demands of prop firm challenges. By combining precision, real-time market adaptation, superior risk management, and high reward potential, this strategy equips traders with the tools they need to pass prop firm challenges with ease.

For traders looking to unlock the potential of prop firm funding, adopting the SMC Orderblock Trend Strategy could be the key to consistent success, offering a pathway to sustained profitability in the competitive world of prop trading.

Get Access To The Strategy