In the dynamic world of stock trading, anticipating market movements and leveraging trends is crucial for your success. While there are many research-oriented strategies, there are some unique ones too.

A sympathy play happens when the stock price of one company rises or falls due to news or price action of another related company.

Pretty neat, right? Of course, there’s much more to it. Let’s get to the explanation.

What exactly is a sympathy play?

A sympathy play occurs because investors anticipate that the news impacting one company will have similar effects on other companies within the same sector or with similar business models.

Essentially, sympathy plays are driven by the market’s perception of the correlation between companies.

Let’s use a few examples to help you understand this better.

Suppose Apple Inc. (AAPL) announces a breakthrough in its new iPhone technology, leading to a significant rise in its stock price.

Investors might then look at other tech companies like Qualcomm (QCOM), which supply components to Apple.

Anticipating increased demand for these companies’ products due to Apple’s innovation, traders start buying shares of Qualcomm and Skyworks, increasing (or inflating) their stock prices.

Didn’t get it? Let me give you a more generic example.

Let’s say Walmart Inc. (WMT) reports better-than-expected quarterly earnings, leading to a sharp increase in its stock price. Traders might anticipate that other big-box retailers like Target Corporation (TGT) or Costco Wholesale Corporation (COST) could also expect better results because of high demand in the market.

Consequently, they start purchasing shares of these companies, driving up their stock prices.

Sympathy plays typically unfold in a chain reaction:

- Primary Event / Catalyst: A significant event or news announcement affects a company. This could be an earnings report, a product launch, regulatory changes, or industry-specific news.

- Initial Reaction: The stock price of the company directly involved in the event experiences a sharp movement, either upward or downward, based on the nature of the news.

- Sympathetic Reaction: Traders and investors anticipate that other companies within the same industry or those with similar business dynamics will be impacted similarly.

How to identify Sympathy Plays?

- Sector and Industry News: Keep a close eye on news within specific sectors and industries. I usually set up news alerts on services like Google News for my preferred sectors.

- Earnings Reports: Earnings season is a prime time for sympathy plays. Strong earnings from a leading company in an industry can boost the stocks of its competitors and suppliers.

- Product Launches and Innovations: A company’s major product launches or technological breakthroughs can lead to increased interest in its suppliers and partners.

- Regulatory Changes: Regulatory approvals or changes can significantly affect pharmaceuticals, finance, and energy industries. When a major player benefits from regulatory news, others in the sector might, too.

- Market Sentiment: General market sentiment and trends can also play a role. Positive or negative sentiment towards an industry can create sympathy plays.

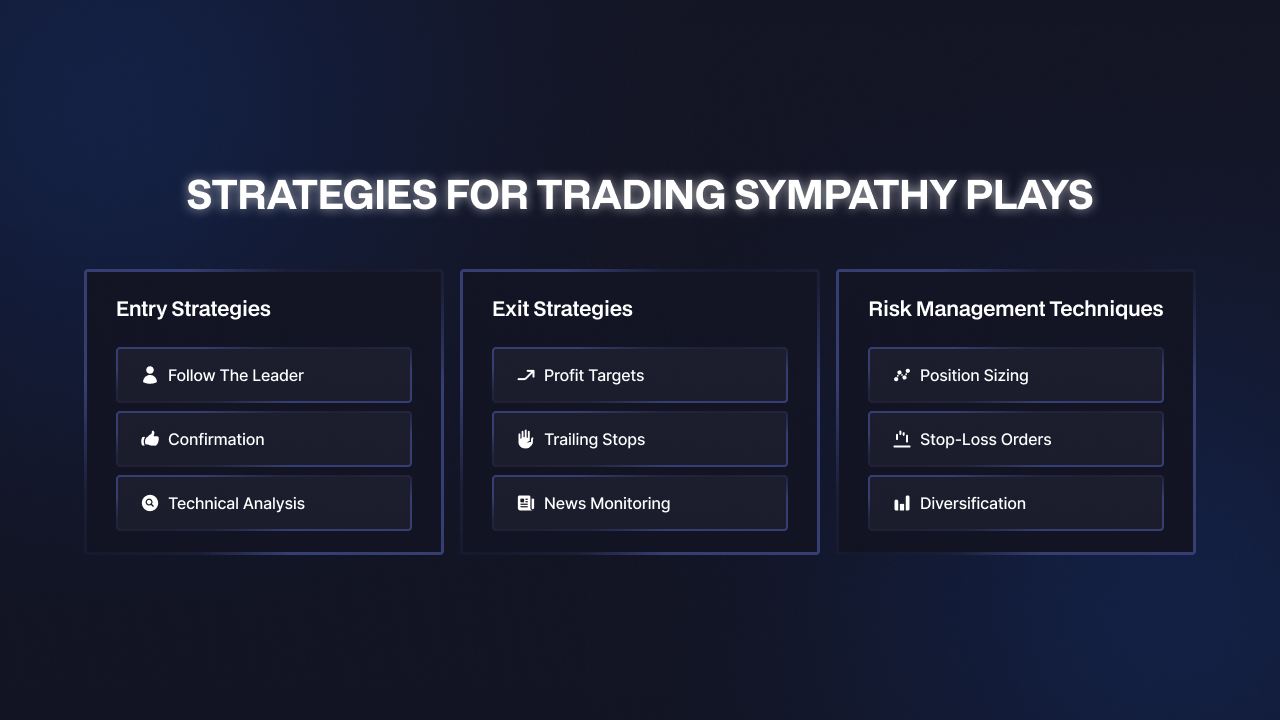

Strategies for Trading Sympathy Plays

Successfully trading sympathy plays requires effective entry and exit strategies, risk management techniques, and practical tips to maximize profits while minimizing risks.

Here’s how to approach trading sympathy plays:

1. Entry Strategies

- Follow the Leader: Enter trades shortly after the primary stock reacts to the news. For instance, if a leading tech company’s stock jumps on positive news, I would consider entering trades in related tech stocks before they have a chance to react fully.

- Confirmation: Wait for confirmation of the sympathy play. Look for related stocks to move in the expected direction before entering the trade.

- Technical Analysis: Use technical indicators to identify potential entry points. Look for patterns like breakouts, trendlines, or moving average crossovers that support the sympathy play.

2. Exit Strategies

- Profit Targets: Set clear profit targets based on your analysis. This could be a specific percentage gain or a key resistance level.

- Trailing Stops: Use trailing stop-loss orders to protect profits as the trade moves in your favor.

- News Monitoring: Stay updated on the news and market conditions that triggered the sympathy play. Be prepared to exit the trade if new information suggests a reversal.

3. Risk Management Techniques

- Position Sizing: Determine the appropriate position size based on your risk tolerance and the stocks’ volatility. Avoid overexposing your portfolio to a single sympathy play.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses. Place these orders at key support levels or a fixed percentage below your entry point.

- Diversification: Avoid putting all your capital into one sympathy play. Diversify your trades across different sectors and strategies to spread risk.

Sympathy Play Issues that Traders Encounter

- Chasing the Market: Entering trades too late after the initial move can reduce profits or losses. Set up alerts to act quickly on potential sympathy plays. Use pre-market analysis to anticipate moves before the market opens.

- Overexposure: Investing too heavily in a single sympathy play can lead to significant losses if the trade doesn’t go as expected. Diversify your portfolio by spreading your investments across multiple trading strategies.

- Ignoring Market Conditions: Failing to consider overall market conditions can result in poor trading decisions. Even if a sympathy play seems strong, broader market trends can impact its success.

- Emotional Trading: Making decisions based on emotions like fear or greed can lead to inconsistent and risky trades. Stick to your trading plan and use automated tools to manage trades objectively.

Advanced Techniques for Sympathy Plays

As you become more experienced with sympathy plays, incorporating advanced techniques can help rake in more profits by improving your trading strategy.

Momentum Trading: Use momentum indicators to identify strong price movements in sympathy plays. Combining the momentum strategy with sympathy plays could help you capture significant price swings.

Swing Trading: Using swing trading techniques, you can capitalize on short- to medium-term price movements.

Mean Reversion: Utilize mean reversion strategies to identify when sympathy play stocks might revert to their average prices after significant movements.