Works on the Following Platforms

TradingView

For use on the TradingView platform

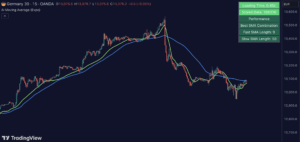

The Adaptive Moving Average (AMA) Signals by Zeiierman is a sophisticated trading indicator that enhances the classic moving average concept by adapting to market volatility. This dynamic adaptation makes the AMA particularly effective in identifying market trends with varying degrees of volatility.

How the Adaptive Moving Average Works

The AMA uses the Efficiency Ratio (ER) to adjust its sensitivity to price changes. The ER measures market directionality over a specified period by comparing the net price change to the total price movements. Based on the ER, the AMA calculates smoothing constants for fast and slow Exponential Moving Averages (EMAs), which are then used to compute a Scaled Smoothing Coefficient (SC). This coefficient adapts the moving average to be faster during trending periods and slower in sideways markets, ensuring that the AMA remains relevant across different market conditions.

Usage of the AMA Signals Indicator

- Trend Identification: Detect bullish or bearish trends based on AMA direction.

- Trend Trading: Align buy/sell signals with upward/downward AMA trends.

- Reversal Trading: Utilize gamma adjustments for potential market turnarounds.

Features of the AMA Signals Indicator

- ER Calculation: Measures market efficiency for adaptive responsiveness.

- Adaptive Smoothing: Adjusts moving averages dynamically.

- Signal Gamma: Customizes sensitivity for trend or reversal signals.

- AMA Candles: Visualizes market trends and reversals.

Conclusion

The AMA Signals indicator offers a sophisticated approach to trend analysis by adapting to market conditions, making it a versatile tool for traders across different strategies and timeframes.