Works on the Following Platforms

TradingView

For use on the TradingView platform

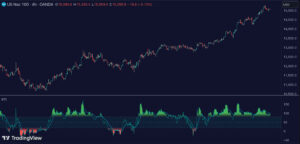

The Adaptive Trend RSI 2.0 is a sophisticated trading tool designed to enhance the traditional Relative Strength Index (RSI) by incorporating adaptive smoothing and leading indicator techniques. This advanced version aims to provide traders with more precise signals by adjusting to market volatility and identifying overbought or oversold conditions more dynamically.

How the Adaptive Trend RSI 2.0 Works

This indicator uses a modified RSI formula that integrates adaptive smoothing and optional leading signal methodologies to track price movements more closely. It offers several modes, including Adaptive Smooth, Adaptive Fast, and Leading RSI, each tailored to different trading styles and objectives.

Key Components of the Adaptive Trend RSI 2.0 Include:

- RSI Type Selector: Allows traders to choose between Adaptive Smooth for more gradual trend changes, Adaptive Fast for quicker reactions to price movements, or Leading RSI for anticipatory signals.

- Customization Options: Users can set the RSI length and tweak settings for the leading mode, enabling a customized fit for their trading strategy.

- Signal Line: An additional RSI signal line can be toggled to provide extra confirmation, enhancing decision-making accuracy.

Usage of the Adaptive Trend RSI 2.0

- Trend Detection: Helps identify the beginning and end of market trends, providing crucial insights for entry and exit strategies.

- Market Sentiment Analysis: Assists in understanding market sentiment by pinpointing overbought or oversold conditions, useful in volatile markets.

- Risk Management: By detecting early signs of trend reversals, it aids in managing trades more effectively, protecting against sudden market movements.

Features of the Adaptive Trend RSI 2.0

- Scalping OBOS Feature: Includes settings for scalping within dynamic Overbought/Oversold areas, tailored for short-term trading.

- Dynamic OBOS Clouds: Offers a visual representation of market conditions through dynamic clouds, which adapt based on market sentiment analyzed through the RSI.

- Divergence Detection: Capable of identifying potential bullish and bearish divergences, adding depth to market analysis.

Conclusion

The Adaptive Trend RSI 2.0 is an innovative tool that transcends traditional RSI indicators by providing a more flexible and responsive approach to momentum trading. Whether used for scalping, trend following, or divergence trading, this indicator offers valuable enhancements to help traders navigate diverse market environments effectively. Its advanced features and customizable settings make it a powerful addition to any trader’s toolkit, aiming for improved accuracy and efficiency in trading decisions.