Works on the Following Platforms

TradingView

For use on the TradingView platform

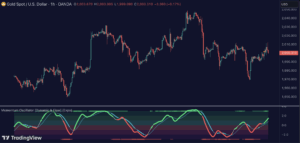

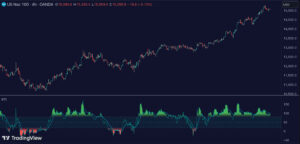

The Dynamic Price Oscillator (DPO) by Zeiierman is a versatile tool designed to measure momentum and volatility in trading markets. By integrating elements of traditional oscillators with volatility adjustments and Bollinger Bands, the DPO offers a unique approach to understanding market dynamics, particularly useful for identifying overbought and oversold conditions, capturing price trends, and detecting potential reversal points.

How the Dynamic Price Oscillator Works

The DPO calculates the difference between the current closing price and a moving average of the closing price, adjusted for volatility using the 1 Range method. This difference is then smoothed over a user-defined period to create the oscillator. Additionally, Bollinger Bands are applied to the oscillator itself, providing visual cues for volatility and potential breakout signals. The incorporation of these elements allows the DPO to dynamically adjust to changing market conditions, offering traders a more responsive and accurate tool for market analysis.

Usage of the Dynamic Price Oscillator

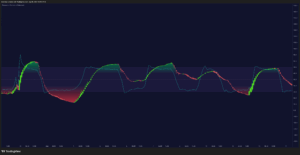

- Trend Confirmation: The DPO can serve as a confirmation tool for existing trends. Traders might look for the oscillator to maintain above or below its mean line to confirm bullish or bearish trends, respectively. A consistent direction in the oscillator’s movement alongside price trends can provide additional confidence in the strength and sustainability of the trend.

- Overbought/Oversold Conditions: With the application of Bollinger Bands directly on the oscillator, the DPO can highlight overbought or oversold conditions uniquely. When the oscillator moves outside the Bollinger Bands, it signifies an extreme condition, signaling potential reversal points or continuation patterns.

- Volatility Breakouts: The width of the Bollinger Bands on the oscillator reflects market volatility. Sudden expansions in the bands can indicate a breakout from a consolidation phase, which traders can use to enter trades in the direction of the breakout. Conversely, a contraction suggests a quieter market, which might be a signal for traders to wait or to look for range-bound strategies.

- Momentum Trading: Momentum traders can use the DPO to spot moments when market momentum is picking up. A sharp move of the oscillator towards either direction, especially when crossing the Bollinger Bands, can indicate the start of a strong price movement.

- Mean Reversion: The DPO is also useful for mean reversion strategies, especially considering its volatility adjustment feature. When the oscillator touches or breaches the Bollinger Bands, it indicates a deviation from the normal price range. Traders might look for opportunities to enter trades anticipating a reversion to the mean.

- Divergence Trading: Divergences between the oscillator and price action can be a powerful signal for reversals. For instance, if the price makes a new high but the oscillator fails to make a corresponding high, it may indicate weakening momentum and a potential reversal. Traders can use these divergence signals to initiate counter-trend moves.

Features of the Dynamic Price Oscillator

- ATR Calculation: Integrates 1 Range method for volatility adjustment, ensuring the oscillator responds accurately to market conditions.

- Bollinger Bands Application: Provides additional visual cues for volatility and potential breakouts, enhancing the oscillator’s utility in different market scenarios.

- User-Defined Period: Allows traders to customize the lookback period, balancing between sensitivity and noise reduction based on individual trading strategies.

- Smoothing Options: Offers adjustable smoothing factors to refine the oscillator’s responsiveness and clarity, catering to both short-term and long-term trading preferences.

Conclusion

The Dynamic Price Oscillator by Zeiierman is a comprehensive tool for traders, combining traditional oscillators with advanced volatility adjustments and Bollinger Bands. Its versatility in identifying trends, overbought/oversold conditions, and momentum changes makes it a valuable addition to any trader’s toolkit, aiding in making informed and strategic trading decisions.