Works on the Following Platforms

TradingView

For use on the TradingView platform

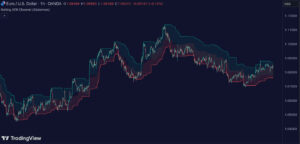

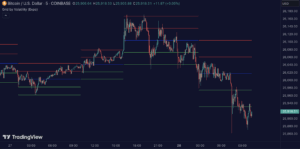

The Harmonic Rolling VWAP (Volume Weighted Average Price) indicator by Zeiierman integrates traditional VWAP with harmonic analysis using Discrete Fourier Transform (DFT). This innovative tool provides a dynamic perspective on price action, highlighting both volume-weighted price levels and underlying harmonic patterns to enhance trend identification and market analysis.

How the Harmonic Rolling VWAP Works

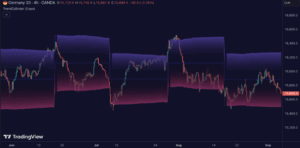

The indicator calculates the rolling VWAP over a specified period, giving greater weight to periods of higher trading volume. This VWAP is then analyzed using DFT, which decomposes the VWAP into its frequency components to reveal harmonic patterns. These components are visualized through standard deviation bands around the VWAP, indicating volatility and potential overbought or oversold conditions.

Key Components:

- Rolling VWAP (RVWAP): Averages price weighted by volume over a user-defined window.

- 1 Range (TR): Measures volatility by comparing current high and low prices with the previous close.

- Discrete Fourier Transform (DFT): Analyzes harmonic patterns within the RVWAP.

- Standard Deviation Bands: Visualize price volatility around the RVWAP.

Usage of the Harmonic Rolling VWAP

- Trend Identification: The RVWAP smooths short-term fluctuations, highlighting underlying trends by focusing on volume-weighted prices. This helps traders identify long-term trends more clearly.

- Volatility Assessment: The standard deviation bands around the RVWAP provide a clear view of price volatility. Expansions in these bands can signal potential breakouts, while contractions might indicate quieter market phases.

- Entry and Exit Points: Traders can use the proximity of price to the bands for making entry and exit decisions. For instance, entering near the lower bands during an uptrend or exiting near the upper bands during a downtrend can optimize trades.

- Harmonic Patterns: The DFT component helps in detecting harmonic divergences, which can be crucial for predicting potential reversals. This allows traders to make more informed decisions based on the harmonic structure of the market.

Features of the Harmonic Rolling VWAP

- Dynamic VWAP Calculation: Adjusts based on trading volume, offering a more accurate representation of the market’s volume-weighted price.

- Harmonic Analysis with DFT: Provides deeper insights into market rhythms and potential reversal points through frequency decomposition.

- Standard Deviation Bands: Offers visual cues for volatility, aiding in the identification of overbought or oversold conditions.

- Customizable Settings: Traders can define the VWAP source, window length, and smoothing parameters, tailoring the indicator to fit various trading strategies.

Conclusion

The Harmonic Rolling VWAP by Zeiierman is a powerful tool that combines volume-weighted price tracking with advanced harmonic analysis. Its ability to dynamically adjust to market conditions and provide visual cues for trends and volatility makes it an essential tool for traders looking to enhance their market analysis and trading strategies.