Works on the Following Platforms

TradingView

For use on the TradingView platform

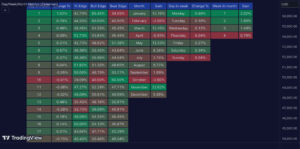

The Optimal Buy Day (Zeiierman) indicator is designed to identify the most advantageous days for buying based on historical price data. It simulates investing a fixed initial capital and making regular monthly contributions, comparing systematic investment on specific days of the month against a randomized buying day each month. This allows investors to determine which days have historically provided the best buying opportunities.

How the Optimal Buy Day Works

The indicator evaluates historical price data to highlight the best and worst days for purchasing shares. It calculates the average price per share for each day of the month and identifies the day with the lowest average price, which typically provides the most cost-effective buying opportunities. Additionally, it simulates random buying days to compare against the systematic approach, offering insights into the potential advantages of regular, planned investments.

Usage of the Optimal Buy Day

Traders and investors can use this indicator to:

- Identify Cost-Effective Buying Days: By pinpointing the days with historically lower prices, traders can schedule their investments to maximize share acquisition.

- Analyze Historical Performance: Comparing systematic investment strategies against random days helps understand the impact of timing on investment returns.

- Optimize Investment Strategies: Using the insights from the indicator, traders can refine their dollar-cost averaging strategies to potentially increase their returns.

Features of the Optimal Buy Day

Key features include:

- Best Price Day: Highlights the day of the month that historically offered the lowest average price per share, indicating the optimal day for buying.

- Randomized Shares and Price: Simulates random purchase days to provide a benchmark against systematic strategies, helping traders assess the impact of their chosen investment days.

- Customizable Settings: Users can set the starting year for the analysis, initial capital, and monthly contribution amounts, allowing for tailored simulations based on individual investment strategies.

Conclusion

The Optimal Buy Day (Zeiierman) is a valuable tool for investors looking to optimize their buying strategies based on historical performance data. By identifying the best days for purchasing shares and comparing systematic strategies to random approaches, it helps traders make more informed decisions.