Works on the Following Platforms

TradingView

For use on the TradingView platform

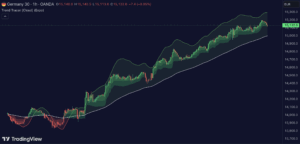

The Predictive Trend and Structure by Zeiierman is an advanced trading indicator designed to forecast future trend directions and identify potential trend continuation levels. It utilizes standard deviation calculations to enhance the predictive capabilities, providing traders with a sophisticated tool to stay ahead of market movements.

How the Predictive Trend and Structure Works

This indicator functions primarily by calculating the standard deviation of the trend over a specified period. It compares the current trend value to previous values and scales the standard deviation, allowing adjustments in sensitivity to price fluctuations. This method enables the indicator to predict upcoming trend directions and identify potential support and resistance levels.

Usage of the Predictive Trend and Structure

Traders can utilize this indicator in various ways:

- Trend Identification: The indicator helps in identifying future trends by displaying trend levels. A price breaking above and staying above the trend level indicates a bullish trend, whereas a price breaking below and remaining below signifies a bearish trend.

- Support and Resistance Levels: By enabling the Predictive Structure feature, the indicator aids in identifying potential support and resistance levels, allowing traders to set strategic entry and exit points.

- Trend Continuation Breaks: These occur when the price breaks through support or resistance levels, indicating that the existing trend may continue. The indicator plots these levels in advance, helping traders to quickly identify where trend continuation might occur.

Features of the Predictive Trend and Structure

Key features include:

- Period for Std Dev: This setting determines the number of periods used for the standard deviation calculation, impacting the indicator’s sensitivity to price changes.

- Standard Deviation Scaler: Adjusts the computed standard deviation, affecting the deviations needed to confirm trends and the indicator’s focus on significant trend changes.

- Predictive Structure: Enables or disables the prediction of market structures like potential levels of structure breaks and trend continuation breaks.

Conclusion

The Predictive Trend and Structure is a valuable tool for traders looking to enhance their market analysis with predictive capabilities. By forecasting future trends and identifying key levels of support and resistance, it helps traders make more informed and strategic trading decisions.