Works on the Following Platforms

TradingView

For use on the TradingView platform

The [Stochastic, MACD – Double-Cross] – Signal Indicator combines the analytical power of the Stochastic Oscillator and the MACD to offer precise trading signals. Developed by Zeiierman, this tool is crafted to optimize the identification of potential market entries by synchronizing the crossover points of these two popular indicators.

How the Indicator Works

This sophisticated indicator employs a dual approach:

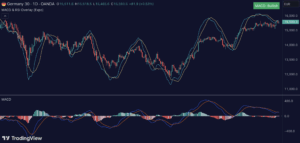

- MACD Component: This part of the indicator calculates the difference between two exponential moving averages (EMAs) to establish the MACD line. A subsequent signal line, which is the moving average of the MACD line, helps in pinpointing potential buy and sell crossover signals.

- Stochastic Component: This component compares the closing price to a price range over a designated period, aiding in the determination of overbought or oversold states. This helps confirm the signals generated by the MACD, enhancing the reliability of the observed trading signals.

Key Features and Settings

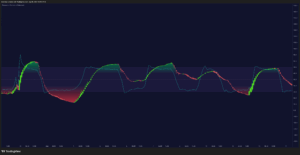

- Configurable MACD Settings: Users can adjust the fast and slow EMA values and the signal line settings, allowing customization according to individual trading styles and market conditions.

- Stochastic Settings: The settings for the %K and %D lines, along with the smoothing, can be tweaked to alter the stochastic oscillator’s sensitivity to price movements.

- Signal Generation: Signals are generated when the MACD line crosses above the signal line, provided that the stochastic indicates the market is not overbought, thus identifying potential bullish momentum.

Usage and Strategy

The [Stochastic, MACD – Double-Cross] – Signal Indicator is versatile:

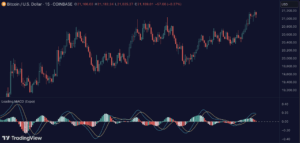

- Trend Confirmation: It confirms potential trend reversals or continuations by requiring alignment in the signals from both MACD and Stochastic indicators, thereby minimizing false signals.

- Identifying Entry and Exit Points: The crossover signals from this indicator can suggest optimal moments for traders to enter or exit trades, especially in trending environments where MACD corroborates the trend’s direction.

- Market Analysis Tool: It serves as a comprehensive tool for analyzing market momentum and trend strength, offering insights that are crucial for making informed trading decisions.

Conclusion

The [Stochastic, MACD – Double-Cross] – Signal Indicator by Zeiierman is a dynamic tool designed for traders who utilize detailed technical analysis in their trading strategy. By integrating signals from both the MACD and Stochastic oscillators, it aims to deliver more reliable and timely trading signals, enhancing trade entry, management, and exit strategies. This makes it an invaluable tool for traders aiming to harness the strengths of these two established indicators in a unified, coherent trading strategy.