Trend & Pullback Toolkit

The Trend & Pullback Trading Toolkit is an all-encompassing suite of tools designed for serious traders who want a comprehensive trend approach. It empowers traders to align their strategies with prevailing market trends, thereby mitigating risk while maximizing profit potential.

The Toolkit helps traders spot, analyze, and react to market trends, pullbacks, and significant trends. It combines multiple trading methodologies, such as the Elliott Wave theory, cyclical analysis, retracement analysis, strength analysis, and pivot analysis, to provide a thorough understanding of the market. All these tools can help traders detect trends, pullbacks, and major shifts in the overall trend. By integrating different methodologies, this toolkit offers a multifaceted approach to analyzing market trends.

- In essence, the Trend & Pullback Toolkit is the complete package for traders seeking to detect, evaluate, and act upon market trends and pullbacks while being prepared for major trend shifts.

The Trend & Pullback Toolkit works in any market and timeframe for discretionary analysis and includes many oscillators and features, but first, let us define what a cycle is:

What is a cycle

This involves the analysis of recurring patterns or events in the market that repeat over a specific period. Cycles can exist in various time frames and can be identified and analyzed with various tools, including some types of oscillators or time-based analysis methods.

- Traders must also be aware that cycles do not always repeat perfectly and can often shift, evolve, or disappear entirely.

Features & How They Work

Elliott Wave Cycles

This is a method of technical analysis that traders use to analyze financial market cycles and forecast market trends. Elliott Wave theory asserts that markets move in repetitive cycles, which traders can analyze to predict future price movement. The core principle behind the theory is that market prices alternate between an impulsive, or driving phase, and a corrective phase on all time scales of trend. This pattern forms a fractal, meaning it’s a self-similar pattern that repeats regardless of the degree or size of the waves.

- The Elliott Wave Cycle Feature uses the principle of the Elliott Wave to identify trends and pullbacks in real-time.

Ratio Wave Cycle

This method elaborates on the concept of how negative volatility, or the degree of variation in the negative returns of a financial instrument, influences the effectiveness of a relative price move. Essentially, it delves into the relationship between the negative fluctuations in the market and the resulting relative price change, exploring how the two aspects interact with each other.

The central concept is that trends are generally more stable and predictable than rapid retracements. Therefore, the indicator calculates the relationship between these two market movements. By doing so, it establishes a trend-based identification system. This system aids in forecasting future market movements, allowing traders to make informed decisions based on these predictions. Essentially, it uses the calculated relationship to discern the overall direction (trend) of the market despite temporary counter-movements (retracements), thereby providing a more robust trading signal.

Periodic Wave Cycle

This refers to patterns or events in price action that recur over a specific time period. Periodic cycles can range from short-term intraday cycles (like the tendency for stock market volatility to be high at the opening and close of trading) to long-term cycles trend cycles. Traders use this to predict future price movements and trends.

- By identifying the phases of a cycle, traders can predict key turning points in the market.

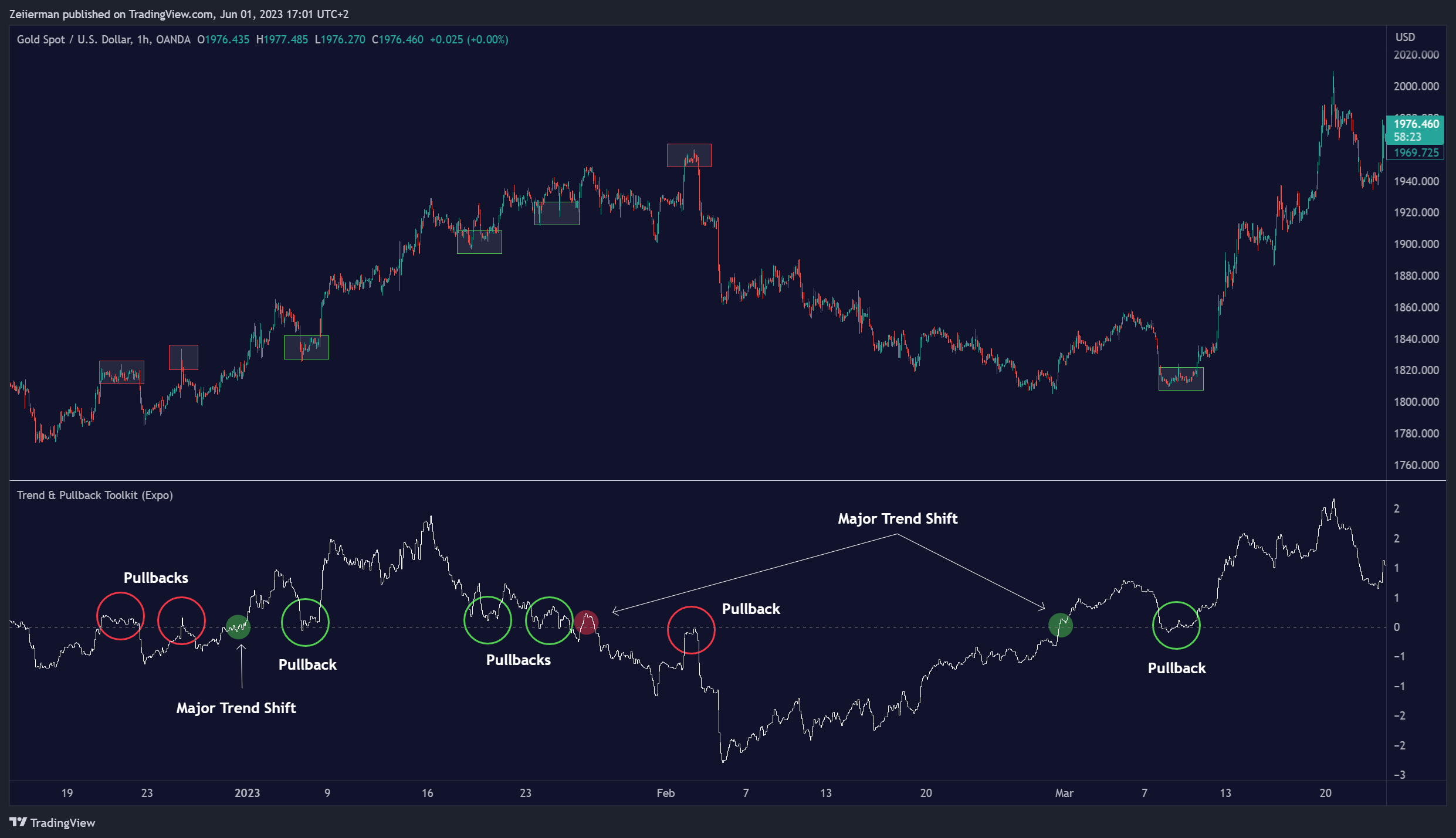

Retracement Cycles

Retracements are temporary price reversals that occur within a larger trend. These retracements are a common occurrence in all markets and timeframes, representing a pause or counter-move within a larger prevailing trend. Retracements can be driven by a variety of factors, including profit-taking, market uncertainty, or a change in market fundamentals. Despite these periodic reversals, the trend (upwards or downwards) often continues after the retracement is complete.

- Fibonacci retracement functions are primarily used to identify potential retracement levels.

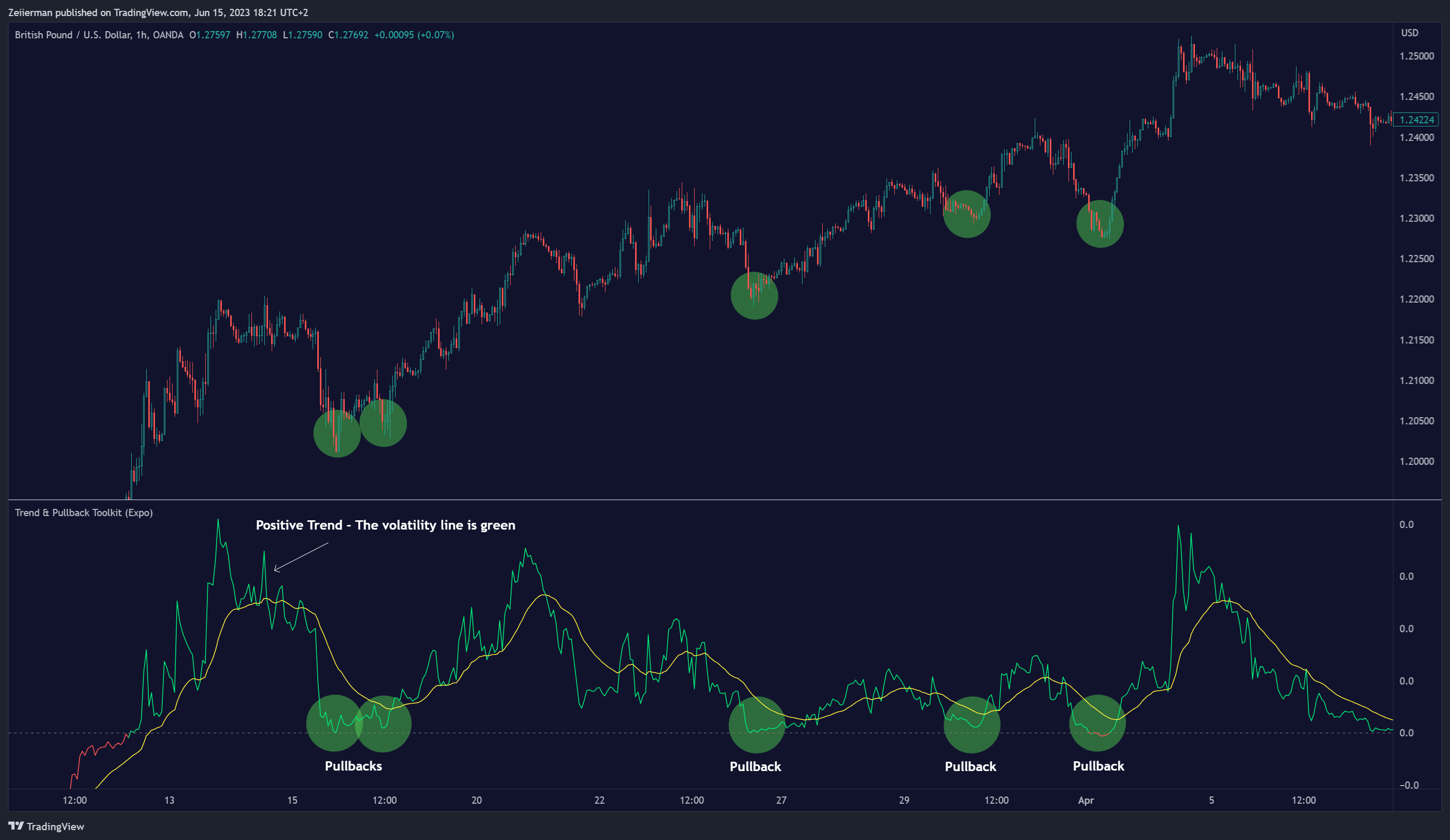

Volatility Cycle

A volatility cycle refers to the periodic changes in the degree of dispersion or variability of a security’s returns, expressed as a standard deviation or variance. This feature uses both measures.

Strength Cycle

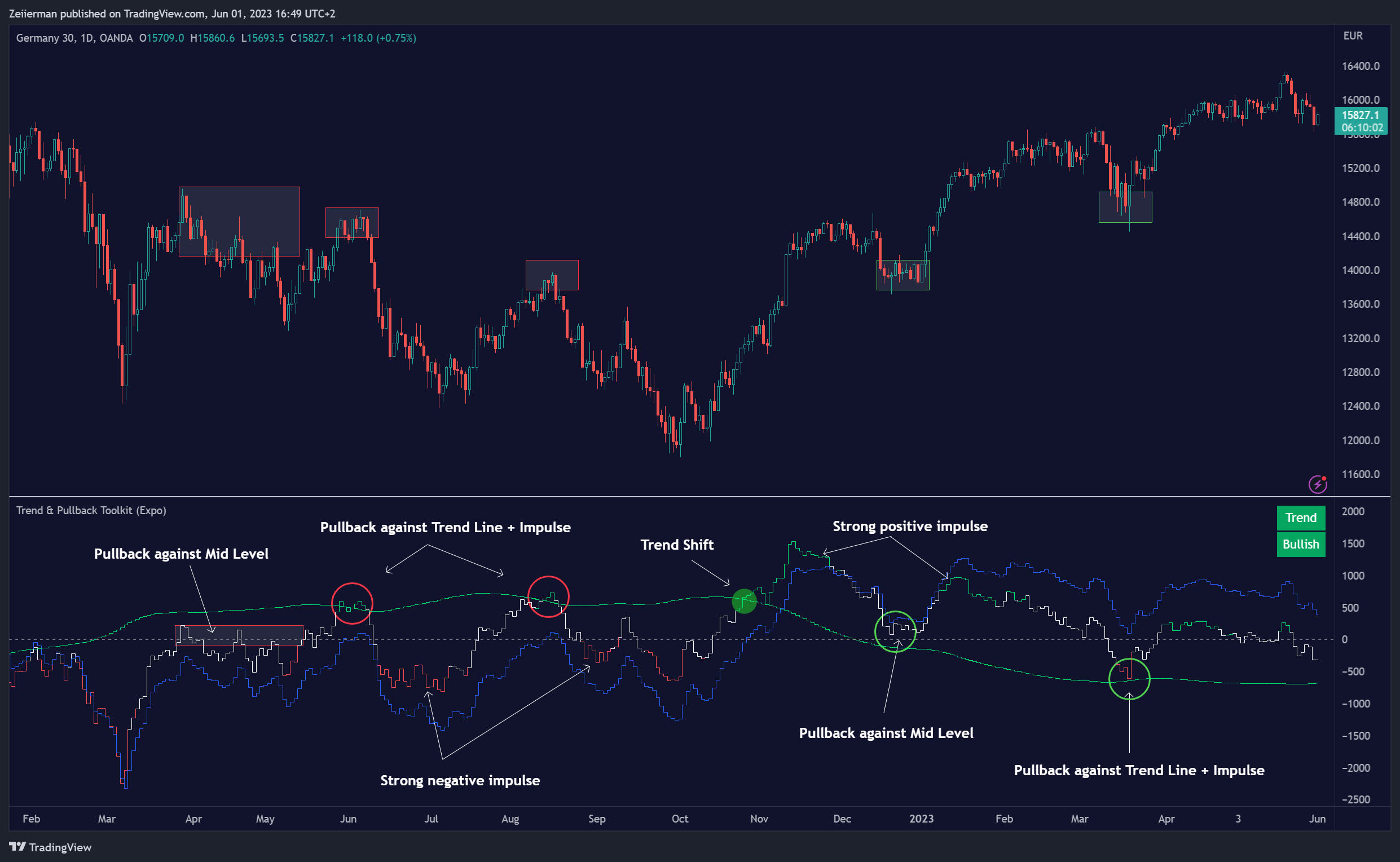

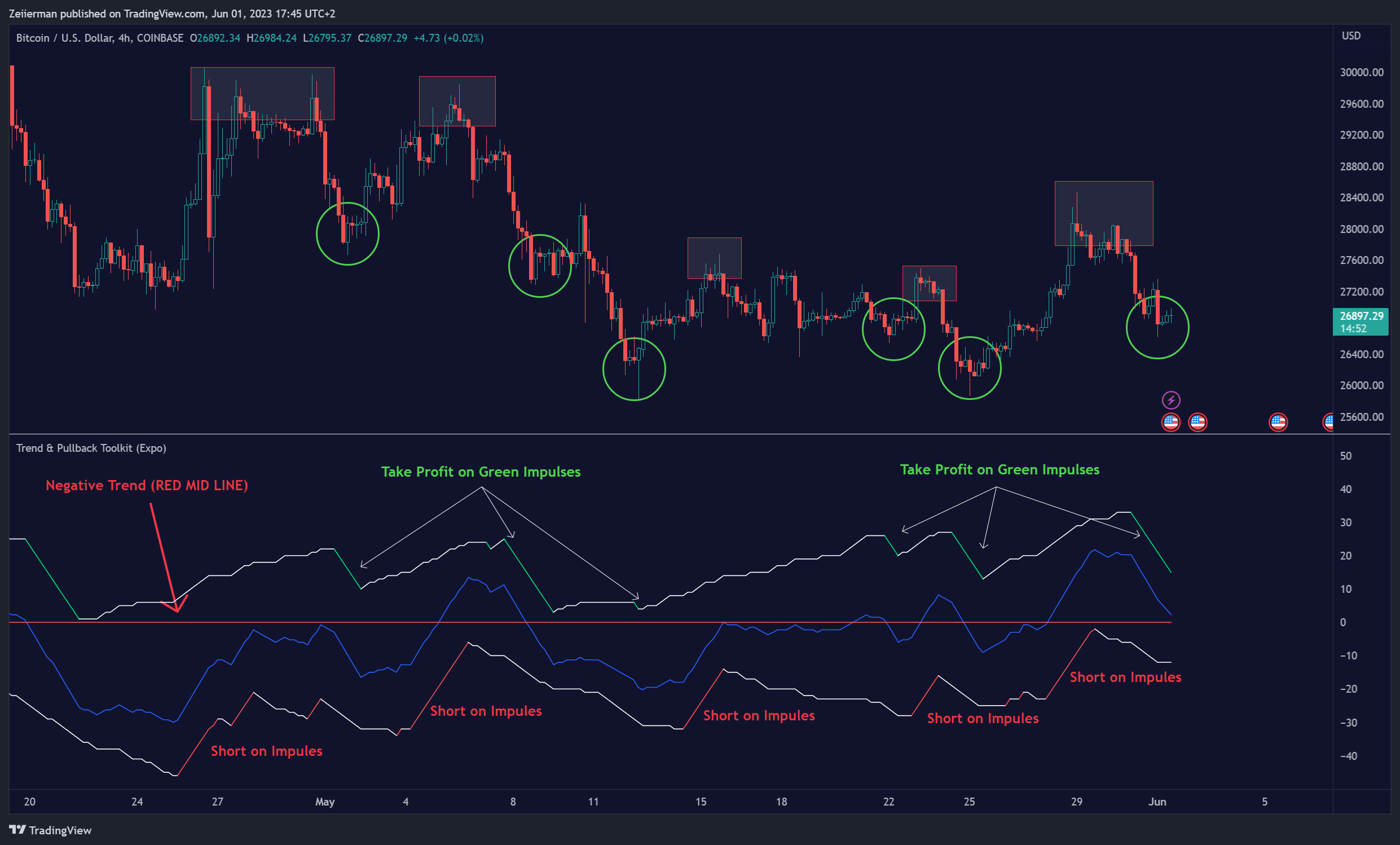

Gauges the power of a market trend and its inherent impulses. This feature offers a broad perspective on the cyclical nature of markets, which alternate between periods of strength, often referred to as bull markets, and periods of weakness, known as bear markets. It effectively tracks the direction, intensity, and cyclic patterns of market behavior.

Let us define what the difference between strength and impulse is:

- Strength: This refers to the power or force behind a price move. In trading, this refers to the momentum or volume supporting a price move.

- Impulse: In the context of trading, an impulse usually refers to a strong move in price. Impulse moves are typically followed by corrective moves against the trend.

Pivot Cycles

Pivot cycles refer to the observation of recurring price patterns or turning points in the market. Pivots can be defined as significant highs or lows that act as potential reversal or support/resistance points. Pivot point analysis helps traders understand the prevailing market sentiment. Overall, pivot cycles provide traders with a framework to identify potential market turning points and price levels of interest.

How to use the Trend & Pullback Toolkit

Elliott Wave Cycles

Ratio Wave Cycle

Periodic Wave Cycle

Retracement Cycles

Volatility Cycle

Strength Cycle

Pivot Cycles

Why is this Trend & Pullback Toolkit Needed?

The core philosophy of this toolkit revolves around the popular adage in trading circles: “The trend is your friend.” This toolkit ensures that you are always in sync with the trend, thereby increasing the chances of successful trades.

Here’s an overview of the key benefits:

- Trend Identification: The toolkit includes sophisticated algorithms and indicators that help identify the prevailing trend in the market. These algorithms analyze price patterns, momentum, volume, and other factors to determine the direction and strength of the trend.

- Risk Reduction: By enabling traders to trade with the trend, this toolkit reduces the risk of betting against market momentum.

- Profit Maximization: Trading with the trend increases the likelihood of successful trades.

- Advanced Analysis Tools: The toolkit includes tools that provide a deeper insight into market dynamics. These tools enable a multi-dimensional analysis of market trends, from Elliott Wave cycles and period cycles to retracement cycles, ratio wave cycles, pivot cycles, and strength cycles.

- User-friendly Interface: Despite its sophistication, the toolkit is designed with user-friendliness in mind. It allows for customization and presents data in easy-to-understand formats.

- Versatility: The toolkit is versatile and can be used across different markets – stocks, forex, commodities, and cryptocurrencies. This makes it a valuable resource for all types of traders.

Any Alert Function Call

This function allows traders to combine any feature and create customized alerts. These alerts can be set for various conditions and customized according to the trader’s strategy or preferences.

In conclusion

The Trading Toolkit is a powerful ally for any trader, offering the capabilities to navigate the complexities of the market with ease. Whether you’re a novice or an experienced trader, this toolkit provides a structured and systematic approach to trading.

The content on Zeiierman Trading is for informational and entertainment purposes, based on personal experience. It is not a substitute for financial advice. Always consult a qualified professional for financial investment guidance. For more details, please read our disclaimer and policies.

Subscribe to our membership